WHAT IS ROBOTICS PROCESS AUTOMATION (RPA)?

RPA is an enabling technology that replaces manual tasks with a set of programmed procedures performed by a “robot,” often referred to as a bot. Like its human counterpart, a bot has system logins, can send and receive emails, perform “swivel-chair” functions by copying data from one source to another, and follow instructions to transform data. It runs in a single-threaded mode accomplishing one task at a time. Tasks can be divvied up across many bots to support the need to scale quickly.

Ideally, an entire process is automated by programming every step. When this is not practical, bots can work in conjunction with humans who perform complex decisions. Bots still enable cost savings and risk reduction for the most repetitive, mundane tasks within the end-to-end process.

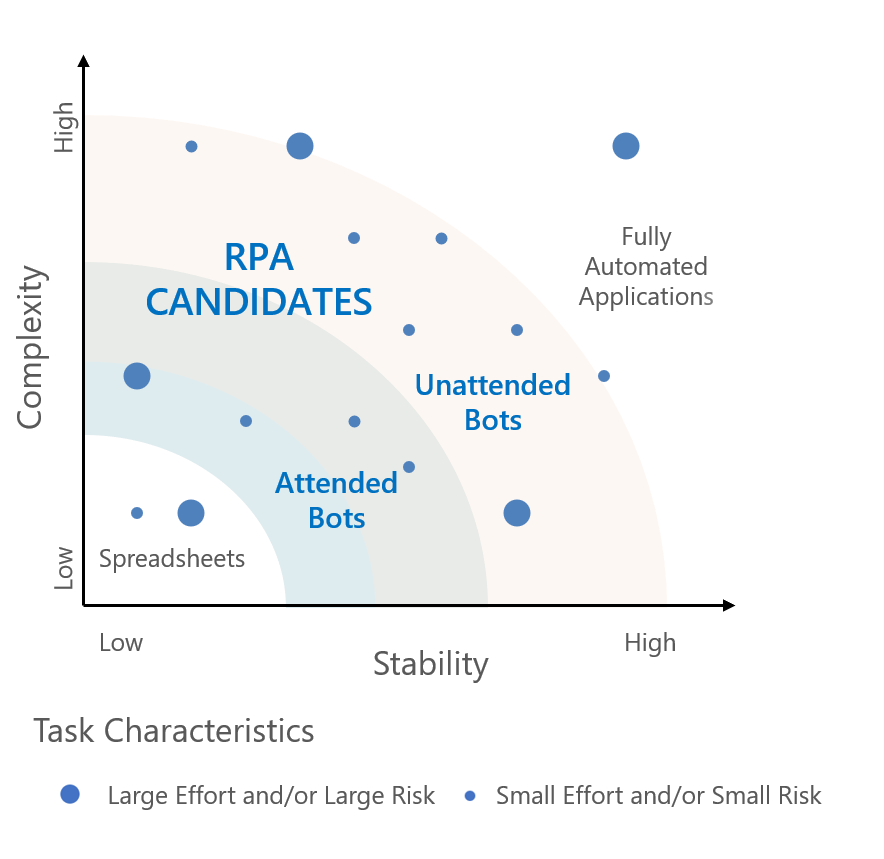

IDENTIFY SUITABLE CANDIDATES FOR AN RPA SOLUTION

The first step in deriving a realistic ROI is to identify tasks eligible for an RPA solution. Manual tasks comprised of moving data from one source to another are excellent candidates for consideration. To narrow tasks down to the most suitable candidates, consider all three critical characteristics of the task: its size, level of stability, and level of complexity. Tasks that are determined to be large (require many hours or are high risk); stable (process and systems are unlikely to change during the near-term) and have a moderate level of complexity (involve decision points) make the best candidates for an RPA solution. Tasks that are deemed small, unstable, and simple do not warrant an RPA solution. Highly complex tasks tied to stable systems are most likely coded as part of an application, so they do not make good RPA candidates either.

EVALUATION CRITERIA FOR RPA CANDIDATES

QUANTIFY POTENTIAL BENEFITS

The next step is to evaluate the potential benefits, including cost savings from reduced headcount and risk mitigation. Consider the sources of information as there may be an unintentional (or intentional) biased input from either an RPA proponent who inflates the possibilities, or someone resistant to change who minimizes the benefits. To achieve the best result, use an objective analyst(s) who follows a well-defined process to quantify the benefits and savings realistically.

QUANTIFY THE EXPENSES

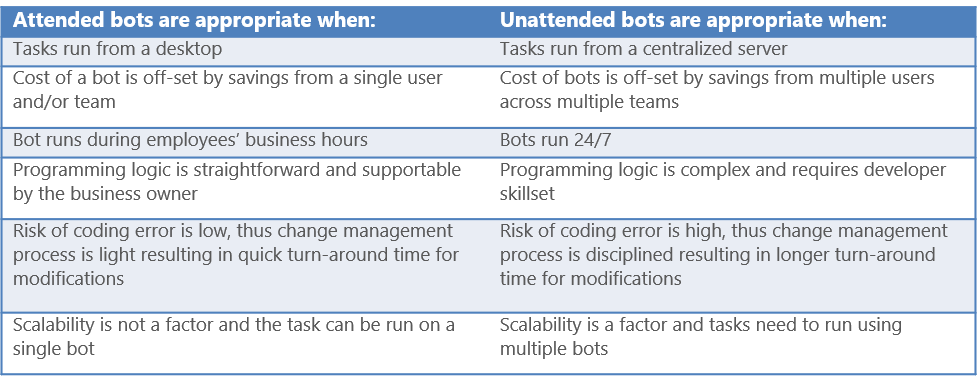

On the expense side of the ROI analysis, inputs can vary significantly depending upon which type of RPA model is appropriate – attended or unattended bots. Attended bots are owned by the business and require a person to run them. Unattended bots are owned by IT, offer more functionality, and only require efforts by humans when there is a problem. Attended bots are less expensive and quicker to implement but serve limited purposes relative to unattended bots.

DECISION CRITERIA FOR DETERMINING THE BETTER RPA MODEL

ANTICIPATING CHANGE

At this point, the ROI is calculated and indicates a go or no-go decision. When faced with a no-go decision, repeat analysis to account for anticipated system or process changes for unstable tasks.

- Will the stability increase enough in the foreseeable future to moderate or high levels? If no, then the decision stands because there was no material improvement to stability.

- Will the size of the effort or the risk decrease significantly due to the anticipated changes? If yes, then the decision stands because now the ROI will be too low.

- If stability level increases to moderate or high, and the size is still large, determine the expected level of complexity. If it is very low, the RPA solution may not be required as the ROI is now lower. If it is moderate to high, then the task will be suitable for the RPA solution, and a determination is needed if an attended or unattended bot should be used in the secondary ROI analysis.

Only after the ROI analysis confidently demonstrates an RPA model has value, should managers begin preparation to implement the RPA solution(s). Preparation can be done concurrently with well-defined system changes.

USE CASE FOR A GO DECISION

An investment management firm is processing trade files received from retirement plan administrators. The files come in different formats that must be modified and then uploaded into the central trading system. The analysis determined that the size of the task is large in both volume and risk, the stability of systems and processes is medium to high, and the complexity of the task is medium. The unattended bot model is preferred to support the ability to scale resources on peak days and to support future demands. The firm moved forward with implementing RPA as a solution because the predicted ROI is attractive and supports its future growth demands. With the RPA unattended bot solution in place, the manager can successfully control the headcount and limit the risks as the volume of trade files increases. The investment continues to deliver a positive return because the on-going costs to add bots are less than the cost to add to headcount.

USE CASE FOR A NO-GO DECISION

An investment management firm uses a spreadsheet to monitor the performance of its funds against peers. This task compiles data from multiple sources via websites, applications, and internal databases. The analysis revealed the task requires a small amount of time, is unstable, requires frequent adjustments, and is low in complexity. The costs for an attended bot would far exceed the time savings in executing these daily tasks, resulting in a negative ROI. When considering the ramifications of system changes that would increase stability, the size of the tasks would decrease. The iterative process reinforced this task is ill-suited for an RPA solution.

HOW MERADIA CAN HELP

The use cases demonstrate opportunities for an RPA solution, as well as the importance of following a process that will successfully optimize your operations. Meradia has proven methodologies and skills to:

- Strategically assess your current state and define your target state

- Perform in-depth analysis to determine the best-fit solution

- Support conversion and implementation to a solution – either an RPA or a fully automated application.

info@meradia.com

info@meradia.com