“As of March 2025, Artificial Intelligence heavyweight Open AI is valued at $300 Billion. Nvidia Corp, one of the largest facilitators of AI, has surpassed Apple to become the world’s most valuable company. More than 25% of all code at Google is now AI generated.” (Channel Insider, WSJ, Fortune) Though seemingly unbelievable, these headlines are accurate and effectively

Read Full ArticleAchieve Clarity With Total Portfolio View

The Challenge of Limited Visibility Leadership is difficult even in ideal conditions. Imagine stepping in as a new Chief Investment Officer (CIO) at a pension fund or endowment, tasked with overseeing all asset classes, only to discover that visibility into total portfolio exposures is fragmented, delayed, or buried across disparate systems. CIOs and investment boards

Read Full ArticleTransforming Business Glossaries to Unleash Data Value

INTRODUCTION Most firms know their data is valuable but capturing that business value can be challenging. Studies show that poor data quality costs organizations an average of $15 million per year (Gartner, Actian). Data governance tools enable employees to independently validate how to use a given field or search for potential matches for a business

Read Full ArticleApplying Machine Learning Techniques in Investment Performance: Uncovering Heuristics to Decipher Data Quality Checks

PREFACE Jose Michaelraj CIPM, CAIA, a Senior Manager at Meradia, specializes in optimizing performance operations and technology for asset managers, asset owners, and custodians. With deep expertise in modern data management techniques, Jose has reorganized performance processes, assessed attribution platforms, and developed a pattern recognizing validation tool. Jose frequently writes about bridging business needs with

Read Full ArticleChange Management: Forgotten? Afterthought? Or Strategic Investment for Success?

INTRODUCTION The significance of change management cannot be overstated in today’s evolving business landscape. Do you genuinely value change management? How do you effectively drive change? What strategies do you employ to ensure success? Often, organizations miss the crucial opportunity to integrate change management at the optimal stage of their projects. When the tide of

Read Full ArticleEnhancing Efficiency in Corporate Actions for OTC Derivatives

INTRODUCTION Every time a portfolio manager says, “What do you mean I can’t do that?” a new derivative type is born. I’m half kidding, there are undoubtedly robust regulations to attempt to limit irresponsible decisions from having an outsized impact on the market, but when red tape or cost gets in the way of something

Read Full ArticleThe Value of Exception-Based Processing

For many in the asset management industry, their days are spent combing through sets of data looking for problems. This is often a result of legacy technology (or inadequately utilizing modern technology) and layered manual controls. There is a better way. Modern technology offers exception-based processing capabilities that bring the power of business rule-driven automation

Read Full ArticleReap More Value From Data in Operational Transformations

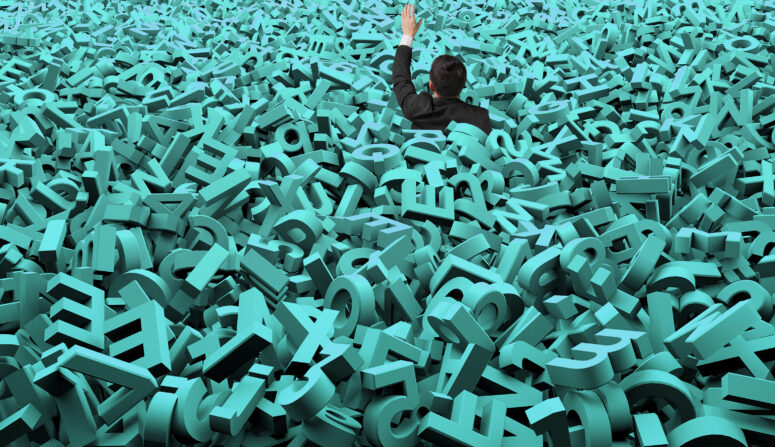

“SURROUNDED BY DATA, BUT STARVED FOR INSIGHTS.” – JAY BAER LEVERAGE CAPABILITIES AVAILABLE IN EMERGING CONVERSION TOOLS TO SUPPORT PLANNING INSIGHTS In the first paper, we said that Performance is Data, sometimes a daunting data challenge. Performance data generation happens in successive layers. Aggregation of holdings creates exposures; changes in market values or exposures create returns; returns lay

Read Full ArticleSolving for Scale: Thought Leadership Webinar

Ready to unlock the secrets behind achieving remarkable growth while maintaining operational excellence? Join four industry experts for a deep dive into the world of investment operations to find out how asset management firms are navigating the delicate balance between expansion and profitability.

Read Full ArticleDon’t Be Afraid of the Mesh

You cannot avoid hearing the term, but what is implied by the term ‘data mesh’? It is the latest step in architecture, governance, and data management evolution. We have lived (or view the history) through the databases to data warehouses, data virtualization, and then to data lakes and now lake-houses. Companies in our industry acknowledge the shortcomings of these frameworks, including accrued technical debt, ongoing and rising costs, and sprawling data lakes, which have not delivered the promised land to analysts and operational business users.

by Andrew Jacob, CFA

Read Full Article info@meradia.com

info@meradia.com