HEDGE FUNDS

Hedge funds are private investment vehicles that employ a variety of non-traditional investment strategies to try to offset risk and create alpha for investors. High investment minimums keep hedge funds out of the purview of most investors and, despite recent trends to increase transparency, these vehicles remain less regulated. Investment performance calculations are standard, yet hedge funds challenge traditional investment performance calculation in several ways.

Late Pricing – Hedge fund valuations (pricing) are less timely than other commingled vehicles. Investment volume and complexity are valid considerations which add to timeliness challenges for hedge fund reporting, as is the desire of the hedge manager to protect sources of alpha. Intentional delays create a window to both tick-and-tie results and provide some protection of intellectual capital where valuation reporting accompanies additional disclosures. Depending on the end-client agreement, hedge fund managers deliver information in a delayed fashion, often incrementally reporting exposures before subsequent reporting of actual positions and pricing. Lags can range anywhere from five to upwards of 30 days. Often end-of-period results will have been reported before final data is available. Depending on a firm’s policy, this creates the need to re-open prior periods and restate results.

Layered Fee Structures – Fees can be layered and include performance fees. The 2 and 20 hedge fund fee structure is typical, with 2% overall management fee on AUM plus 20% on profits that exceed a specified threshold. Both AUM-based fees and performance-based fees are charged at different intervals, with AUM-based fees typically charged monthly and performance-based fees annually. Resulting net of fee returns must include both AUM-based and performance-based fees.

Inclusion of Fund Details in Overall Investor Exposure Reporting – Hedge funds often provide details indicating sources of alpha and exposure. Including these partial details can enhance overall transparency for investors but can be tricky as inputs are often manual and incomplete.

PRIVATE EQUITY

Success in private equity, as evidenced by positive performance returns, comes from successfully buying or building success in underlying company investments. Since this doesn’t happen overnight, true private equity valuation takes time. With private equity, investment performance can only be accurately measured when all the investments have been liquidated, and lifetime cashflows of the investment fund are fully-known. Interim performance is an imprecise yet necessary evil as investors are justifiably not patient enough to wait the requisite 10 years until all the dust is settled and returns are final.

Private equity funds are valued quarterly and provided to investors with a lag of three to six months. Preliminary valuation often, but not always, precedes a final valuation. It is not unusual for private equity managers to be reporting, for example, December 2018 valuations during June or July 2019. Lagged valuations create the largest hurdles for regular, timely investment performance reporting. The challenges include:

Late Pricing – Private equity valuations are predictably late. Valuations lag reporting periods by three to six months.

Private Equity Managers Publish Preliminary, and then Final Pricing – As pricing iterates from preliminary to final, valuations and performance numbers change. Changes may result in restatement triggers if new returns exceed materiality thresholds.

Negative Valuations – Since private equity investments are valued infrequently, a holding held at cost that was sold for a large gain might have negative valuations.

Imperfect Calculation Methods – Portfolio manager discretion over cash flow timing suggests internal rate of return (IRR); but lumpy cashflows dismost fund-level calculation methods. [i] Also multiple changes in the sign of cumulative cash flows might lead to more than one mathematical IRR. Since tort IRR is itself unstable, it is typically presented along with other ratios such as Investment Multiple and Realization Ratios that measure the wealth earned over the investment horizon. [ii]

Calculation Methodology Changes with Use – Individual investments use an IRR or a modified IRR when calculating a return. When shown within the construct of an asset class structure, both the investment and the private equity node should be calculated with modified Dietz methodology. When the performance reporting is focused on an individual fund or comparing more than one fund, IRR is a preferred evaluation mechanism since the portfolio manager has discretion over timing of investment-level capital calls and disbursements. When the performance reporting; however, focuses on the asset class view, cash flows are aggregated in the context of the private equity node as part of the overall asset hierarchy – modified Dietz enables cross-asset rollups.

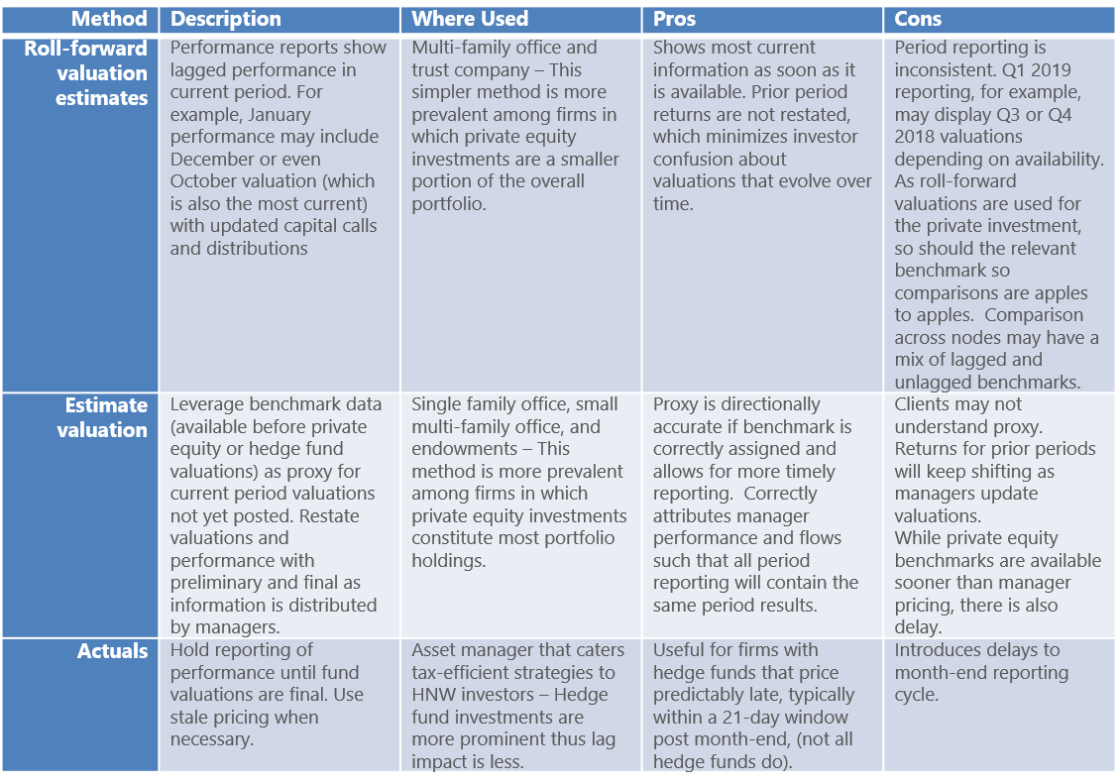

VALUATION OPTIONS: PROS AND CONS

The table below presents options for filling the gaps created by late pricing. All methods presented have merit and are widely used in the market. Best practices dictate that firms state which method has been applied and what happens to the subsequent and final valuations in reporting disclosures. Changes from proxy to prelim, and later from prelim to final, can result in material performance differences. Best practice further dictates that when these differences are material that they be highlighted and disclosed. [iii]

THE CASE FOR ESTIMATED VALUES

Firms make choices to fill gaps created by lagged valuations. The method chosen should be appropriate to audience since level of understanding and tolerance for the instability of underlying returns is an important consideration. The use of estimated values is most prevalent in single family office or large endowments where level of sophistication for the end-investor is extremely high. Estimated values method will most closely reflect investments as reported performance and valuation evolve as newer information becomes available. One can argue that this method provides adequate transparency, most accurately reflects known information soonest and provides room for revisions. It has the added benefit of intuitive time periods that align with an overall portfolio strategy. Roll-forward pricing makes sense when the final data is not yet available; but is less meaningful over long time horizons when private investments periodicity is out of sync with the rest of the portfolio. Proxy data from benchmarks available sooner is used until preliminary valuation data is available. Benchmarks published by Cambridge Associates [iv] or Hedge Fund Research (HFR Indexes) [v] are common proxies for lagged valuations. While benchmarks are an imperfect proxy, benchmarks that reflect vintage year and overall market conditions are a better representation of current period changes.

To summarize, benchmarks provide the initial approximations. Preliminary valuations replace proxy benchmarks. Final valuations replace preliminary valuations closing the loop. The entire process is predicated on systems that support multiple restatements and client service representatives that can explain the changing returns to impacted investors.

CONCLUSION

Hedge fund and private equity investment performance is highly-dependent on the quality of accounting inputs. Accounting for private equity challenges staff and systems with manual, and sometimes confusing interpretation of fund manager statements. Fit-for-purpose tools can reduce operational complexity and add transparency for investment reporting. There is no one-size-fits-all approach for handling the data challenges associated with private investments. Firms choose methods based on customer sophistication and capabilities of supporting platforms.

HOW MERADIA CAN HELP

Meradia has proven methodology and skills to help asset managers improve their performance reporting and the data that supports it:

• Performance, risk and analytics

• Information delivery and reporting

• Process design and change

[i]The Hazards of Using IRR to Measure Performance: The Case of Private Equity. Ludovic Phalippou, Ph.D Journal of Performance Measurement, Summer 2008

[ii] Inside Private Equity: A Professional Investors Handbook – James M. Kocis, James C. Bachman IV, Austin M. Long III & Craig J. Nickels.

[iii] Global Investment Performance Standards: Guidance Statement on Private Equity https://www.gipsstandards.org/standards/Documents/Guidance/gs_private_equity_clean.pdf

[iv] Cambridge Associates publishes several private equity indexes: https://www.cambridgeassociates.com/private-investment-benchmarks/

[v] Hedge Fund Research publishes several hedge fund indexes: https://www.hedgefundresearch.com/family-indices/hfri

Download Thought Leadership Article Solution Design Performance, Risk & Analytics Asset Managers Laurie Hesketh info@meradia.com

info@meradia.com