INTRODUCTION

Our previous papers in the asset owner series dealt with a variety of topics in the performance value chain. The first paper discussed valuation challenges posed by higher allocations to private markets, external asset management, and managing multiple books of record. Our second explored multiple return methodologies to provide meaningful performance returns. In the third outing, we highlighted how a GIPS® framework enables complete & reliable data for the CIO and risk office. In this final part, we discuss the challenges faced by utilizing conventional models for total fund attribution and recommend a framework that integrates policy weights and process-based attribution.

The central issue

Comparative performance measurement started with BAI studies in 1968, but attribution analysis itself started with Fama in 1972¹. Since then, a plethora of attribution models have been developed in the industry. Brinson, factor-based and strategy algorithms have specific and targeted uses within the asset management industry. But they could be less relevant in an asset owner context. Fitting algorithms to portfolio management is more than a mathematical exercise. The intent of attribution is to provide insight into the actual structure of the system being addressed². That begets the question – What is the structure of underlying asset owners?

Our analysis of the asset owner landscape reveals three key elements:

- Objective definition – Performance attribution can be thought of as understanding the reasons for the “achievement relative to objective³. Within asset owners, the objective is not only beating the benchmark. It also includes meeting the liabilities and adherence to risk limits of multiple mandates. The keyword is multiple. Mandates roll up to a single, total-level fund entity.

- Allocation targets – Strategic allocation targets guide the asset owner’s long-term goals and risk tolerance. Tactical asset allocation aims to benefit from transient market conditions. This characteristic could be considered representative of a multi-asset portfolio at an institutional asset manager.

- Federated decision-making – Key decisions are taken by different teams at various steps in the investment management process. Strategic asset allocation, rebalancing drift, tactical asset allocation, and external manager selections are typically shared by the Board and CIO. Currency overlays and hedging strategies are employed at the total fund level. Portfolio construction experts are tasked with diversifying and tilting portfolios. Asset class managers have autonomy over segment or sector allocation, while portfolio managers execute trading strategies.

Under the above circumstances, conventional attribution models are stretched to reveal the true value added.

For example, Brinson models might not reveal the impact of currency & derivative overlay strategies executed at the total fund level. In a more controversial practice, the Brinson models used on a sample of pension funds demonstrated that most of the difference in returns among pension funds is the result of policy decisions, not timing or selection⁴.

Factor-based models might force fit or overfit certain aspects. Not all factors remain relevant, and it might be difficult to identify the right number of factors. Factor-based models could be useful from a risk lens but provide little value from an attribution standpoint unless investment decisions are made primarily based on those factors. Also, with most mandates being multi-asset classes, each asset class might require its own factor model.

Strategy-based attribution may fit an asset class well. Operational complexity in trade tagging, allocating events (corporate actions, benefits disbursement) to strategies and handling multi-legged derivatives exacerbates the complexity for total fund fitment.

Proposed framework

For attribution analysis to be meaningful, the structure and order of decisions must accurately reflect how the organization makes investment decisions⁵. A process-based attribution framework integrated with policy weights calculation best fits the asset owner use case.

PROCESS–BASED ATTRIBUTION (PBA)

Why do we think PBA is well-suited for asset owners?

- Alignment – Accurately maps the investment decision-making process. Because it is a framework, not an algorithm, it can be customized to each firm.

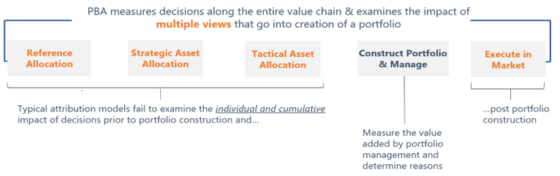

- Holistic – Embodies a total portfolio approach. It measures decisions along the entire value chain & examines the impact of multiple views that go into creation of a total fund – both prior and post portfolio construction.

- Intuitive Modelling – The math is straightforward. Previous decision is the benchmark for each subsequent decision. The value-added is difference between the two. The structure of an asset owner can be modeled as sequential decision-making steps commencing from reference allocation views at the total fund to trading decisions within an asset class. It’s based on breaking down and analyzing the investment process rather than inferentially analyzing past data.

- Pragmatic – Measures changes in terms of returns or dollar value-added. Helps in transparent communication to beneficiaries and other stakeholders.

Source: Meradia

POLICY RETURNS

Policy weights denote allocation mandates and are an important component of the total fund investment strategy for asset owners. They specify the ranges within which the asset classes can ‘fluctuate’ and provide feedback to stay within prescribed limits.

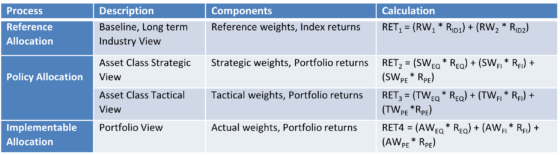

Policy returns calculated from policy weights and asset class returns are an important first step in determining the stepwise value add. An illustration might help (see next page). Assume an asset owner invests in three asset classes: Equity, Fixed Income & Private Equity.

Conventions for weights and returns:

RW1 = Long term weight of asset class 1 of a reference portfolio

RW2 = Long term weight of asset class 2 of a reference portfolio

RID1 = Index returns for Asset class 1

RID2 = Index returns for Asset class 2

SWEQ = Strategic allocation weight of Equity asset class

SWFI = Strategic allocation weight of Fixed Income asset class

SWPE = Strategic allocation weight of Private Equity asset class

TWEQ = Tactical weight of Equity asset class

TWFI = Tactical weight of Fixed Income asset class

TWPE = Tactical weight of Private Equity asset class

AWEQ = Actual portfolio weight of Equity asset class

AWFI = Actual portfolio weight of Fixed Income asset class

AWPE = Actual portfolio weight of Private Equity asset class

Asset class returns:

REQ = Equity asset class returns

RFI = Fixed Income asset class returns

RPE = Private Equity asset class returns

Typically, reference portfolio views are based on a 60/40 or a 75/25 allocation to Equity & Fixed Income, respectively.

Source: Meradia

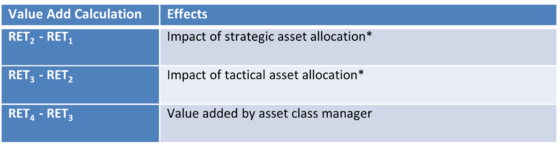

These calculations can be extended to accommodate leverage, rebalancing, and floating weights. Incorporating them into a PBA framework, we obtain the following insights.

Source: Meradia

*Assuming these decisions are made outside of the asset classes, Combined, they represent the value added by the CIO/total fund team.

Process-based attribution – a top-down attribution framework, is not a panacea to the much-debated asset owner attribution process. It uncovers where and how much value was added along the process, not why value was added. Asset class specific attribution algorithms incorporated into the PBA framework could reveal them. It is quite difficult at times to obtain consensus on targeted long-term objectives and notional policy portfolios. That said, the framework illustrated herein could be beneficial over most other conventional models.

CONCLUSION

Asset owners looking to derive more meaningful insights into value-added performance may benefit from incorporating a process-based attribution framework that reflects their unique decision-making structures. By integrating process-driven steps into performance analysis, a clearer and more pragmatic picture of how various strategic and tactical decisions affect overall fund outcomes may be attained. However, this approach does not necessarily displace traditional attribution methods. Rather, the two approaches might be used in a complementary manner, with traditional attribution providing detailed insights into asset allocation and security selection, while process-based attribution focuses on the steps in the broader investment decision-making process. Together, these methods can offer a more comprehensive toolset for understanding the drivers of performance and enhancing clarity on how both decisions and processes influence total fund outcomes.

REFERENCES

¹Performance attribution – History And Progress, CFA institute.

²The Decomposition Verses The Decision- Evaluation of Active Risk-Adjusted Returns, Andre Mirabelli

³Investment Performance of Pension Funds – Holbrook, 1977.

⁴Performance attribution – History And Progress, CFA institute.

⁵Rethinking Investment Performance Attribution – Jagdeep Singh Bachher, Leo de Bever, Roman Chuyan, and Ashby Monk

Download Thought Leadership Article Solution Design, Strategy and Roadmap Performance, Risk & Analytics Asset Owner Jose Michaelraj info@meradia.com

info@meradia.com