Reclaimable withholding taxes from foreign dividends and income present challenges for asset managers and asset owners. This paper examines operational challenges associated with investment performance calculations, specifically pertaining to a global portfolio with investments in multiple countries. Challenges discussed include jurisdictional nuances, uncertainty of collecting receivables, and delayed reclaims. Additionally, this paper addresses the advantages and disadvantages of several calculation methods.

Cash Basis Versus Accrual Basis

Understanding the difference between cash basis and accrual basis is a crucial concept when determining how to account for cash, and it will be clear later in this paper why it is so important. The main difference between accrual and cash basis accounting is when revenue and expenses are recognized. The accrual method focuses on the timing of anticipated revenues and expenses, while the cash method recognizes them when the cash exchanges hands. While this distinction may seem insignificant, it can have a material impact on performance results.

Impacted Party

The domicile of the owner of the asset dictates what tax treaties are in effect. For an institutional client, the fund is the owner, and if it is a fund domiciled in the United States, the tax treatment is determined by the treaty of the U.S. and the country in which the security is issued. For separately managed accounts, the asset owner may have more favorable tax treatment depending on the type of entity it is, such as public pensions. The identification of the impacted party is critical as the tax treatment determines the withholding tax rate and, therefore, the reclaimable withholding tax amount.

Reclaimable Withholding Taxes

As the world becomes more interconnected, firms face the challenge of navigating the complicated global tax landscape. Companies are subject to withholding rates of up to 35 percent of their investment income but often can claim a reduced rate under an income tax treaty. This investment income includes foreign dividends, income, and capital gains, so it impacts fixed income, equity, and derivative products.

Jurisdictional Nuances

Withholding tax reclaims vary from country to country and tend to be quite onerous. Investment portfolios that receive investment income must go through each applicable country’s process to receive the proceeds to which they are entitled. Additionally, the tax reclaim process can be quite complicated, requiring extensive documentation, special requests, and different workflows. The tax rates also vary significantly across jurisdictions, and there is inconsistent processing by tax authorities, impacting the likelihood of payment. Requirements also change over time. Jurisdictions sometimes impose a holding period requirement to ensure the main purpose of the acquisition was not to avoid withholding tax on income. There is often an exception process to prove otherwise, but trading around entitlement date could result in partial payments or rejection (as is the case in Belgium). Some countries, including France, require additional plan documentation and incomplete documentation will result in rejection.

Uncertainty of Collecting Receivables

Assuming the investment manager or pension fund takes the appropriate steps and completes the required documentation, there is a high level of certainty in most markets that they will receive the tax reclaim that they are entitled. However, for certain jurisdictions, the probability is less certain. Most markets across Asia, Scandinavia, the United Kingdom, and Ireland are consistently paid within 12 months, while some markets in Central and Eastern Europe have much more nuanced requirements that can impact the likelihood of collection within a reasonable timeframe. In some cases, it can take up to 12 years for repayment. Several markets are adopting electronic filing, which is expected to improve collectability and streamline processing. These improvements, however, are relatively recent and there isn’t a proven track record of new timeframes. It is difficult to account for a reclaim when there is skepticism around its reception.

Delayed Collection

Withholding tax reclaims can take anywhere from six months to over 10 years. This varies by jurisdiction and is part of why investors prefer “relief at source”. This occurs when the investor pays the lower treaty rate when the income is earned and therefore does not wait for a future receivable. Only a handful of countries currently leverage relief at source (such as the US), although other countries are in the process of adopting it.

Growing Receivable Balances

A topic often discussed is whether to take action on growing outstanding receivable balances that have been accrued and are part of the net asset value (NAV) and historical performance. Technical accounting rules suggest keeping the accruals if you are more likely than not to receive payment. As we have covered, reclaimable balances in several markets are unlikely to be paid. Certain clients may take a risk management approach and trim existing balances, but that has an impact in the period of the adjustment, which will drive underperformance. Actual rates of collection haven’t changed much in the past several years.

Index Behavior

Index methodology differs significantly across benchmarks. It is important for portfolios to be benchmarked against an index that has similar tax treatment. This applies mostly to international funds that have a wide variety of withholding rates. It’s common for index providers to publish both a tax-free (gross) and after-tax (net) version of their indices. To convey the true after-tax return that an investor would receive, comparing the after-tax returns (inclusive of withholding tax) with that of a benchmark utilizing a similar methodology will provide the greatest level of transparency. Benchmark providers often publish their net returns assuming the maximum withholding tax rates (i.e., they do not include the benefit of double taxation treaties). Additionally, because index providers use these withholding rates as a proxy, they do not discount future reclaims or write them off but rather assume that accruals are realized when the dividend is paid. As asset managers and asset owners can be subject to different tax treaties, they might have different withholding taxes than what the index provider utilizes.2,3

Tax Efficiency

Tax-managed portfolios exist that look to provide outsized after-tax returns by leveraging various tax strategies. One popular tax strategy is coupon or bond washing. This is where a security is sold immediately prior to a coupon or dividend payment, and then repurchased after the coupon/dividend has been paid. This avoids the income payment and can generate after-tax outperformance. Portfolios that leverage this and similar strategies should not accrue withholding tax and reclaims as they are not realized.

Accounting Treatment: ABOR versus IBOR

Accounting books of record (ABOR) provided by a fund administrator typically accrue both the net dividend and reclaimable amount of taxes withheld. Only the tax expense – which is known to not be reclaimable – is expensed on ex-date. Investment books of record (IBOR) have historically accrued gross and received net, expensing the difference on payment date. This is in line with the primary use of an IBOR, focused on start-of-day positions and cash on hand for trading purposes. As cash management has become a greater area of focus, treatment of income accruals is converging between ABOR and IBOR. Asset managers are looking for the most accurate treatment in their IBOR records to inform portfolio managers of investable cash.

Calculation Options: Advantages and Disadvantages

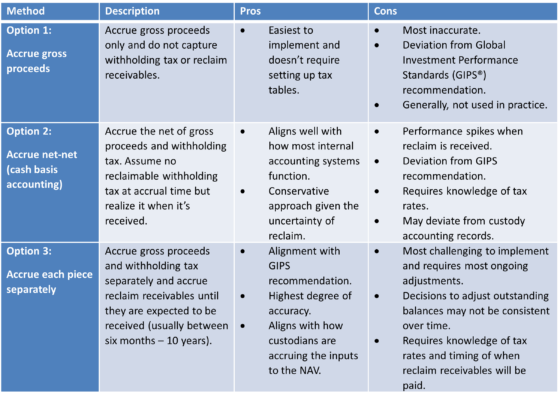

The table below presents options for reflecting (1) gross proceeds, (2) withholding tax and (3) tax reclaim receivables. All methods presented have merit and are widely used in the industry. Industry standards dictate that firms disclose which method has been applied, as well as how they are updated when the reclaim is finally received.

Source: Meradia

Operational Implications

Maintaining long-term accruals across multiple year-ends is an obvious operational headache. Ensuring an itemized view of each reclaimable tax by instrument is onerous given timing, on-going trading activity, and the need to write-off a portion of accruals on a regular basis. Consider the likely scenario of a reclaim being maintained well after the related bond position is sold-off. Practicality usually dictates how firms manage tax-reclaim suspense accruals, such as through net balances in an accounting system chart of accounts or in detail through an accounting system capable of maintaining tax-lot reclaims on sold positions.

GIPS Recommendation

According to the GIPS standards, “Returns should be calculated net of non-reclaimable withholding taxes on dividends, interest and capital gains, and reclaimable withholding taxes should be accrued.”¹ While the GIPS recommendation is a great guiding principle, ideally it would go one step further and discuss how to apply the principle in a real-world environment.

Recommendation

In a perfect world, all parties (asset owners/managers, custodians, fund accountants, and index providers) would accrue reclaims to when they are both expected and realized. Due to several of the challenges listed above, that is not practical. The custodian provided accounting book of record (ABOR) does accrue to receipt but there is subjectivity in writing down balances where collection is uncertain. Clients may take a risk management approach and have different policies which are used to direct custodians to write down receivables. While the lack of an industry best practice around write-downs of reclaimable balances causes challenges in comparability by fund, it is best to align with the ABOR and NAV based published performance and disclose the fund policies on reclaimable balances and the impact on performance. In conclusion, we recommend using Option #3 presented above as it provides the highest level of accuracy.

REQUEST FOR FEEDBACK

How does your firm treat reclaimable withholding taxes? Do you agree with the proposed approach? Are there other operational factors or constraints that should be considered? We welcome feedback as we work towards determining industry best practice. Please direct feedback to info@meradia.com.

REFERENCES

¹ “Global Investment Performance Standards (GIPS) for Firms.” CFA Institute® Global Investment Performance Standards. gips-standards-for-firms-explanation-of-provisions-section-2.ashx (cfainstitute.org)

² “MSCI Index Calculation Methodology.” MSCI. https://www.msci.com/index-methodology

³ “Withholding Tax Rates Used in Net-of-Tax Indexes (v3.3).” FTSE/Russell. Withholding Tax Rates Used in Net-of-Tax Indexes: Ground Rules (lseg.com)

GIPS® is a registered trademark owned by CFA Institute.

Download Thought Leadership Article GIPS® Advisory, Investment Accounting, Performance, Risk & Analytics Service Providers & Outsourcers Jonathan Boersma, Ryan Bond info@meradia.com

info@meradia.com