INTRODUCTION

In the first paper of our asset owner series, we explored the unique business drivers, valuation methodologies, and considerations for private market and external manager processing. Now, in our second installment, we shift our focus to returns and benchmarks.

Asset owners often invest across a diverse mix of private and public market asset classes. But should the same return methodology be applied to both the asset class and the total fund level? Are there acceptable deviations?

Sophisticated benchmarking capabilities are essential for accurately consolidating returns at the total fund level. The complexities of substitution and benchmark specific overrides present challenges driven by various underlying factors. What are these factors, and how can best practices help overcome these challenges? Read on to discover our perspectives and practical solutions.

TWR vs IRR

TWR and IRRs can coexist: Navigate the IRR landmines.

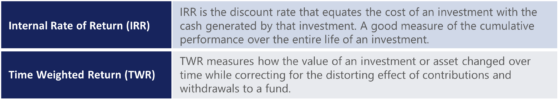

The debate between time-weighted returns (TWR) versus internal rate of returns (IRR) is longstanding in the industry. In many cases, it seems there is a choice to be made between one over the other. However, within the asset owner space, both have their place.

Asset owners, with their longer horizons and diverse investments across public and alternative asset classes, benefit from leveraging both TWR and IRR. It is a long-standing aphorism in the industry that ‘Diversification is the only free lunch’¹. TWRs are particularly meaningful for publicly traded asset classes and the total fund. Their ability to accommodate asset class weighting and bottom-up calculation makes them ideal for rolling up returns. Conversely, IRRs are well-suited for alternative asset classes such as Real estate and Private Equity, where the manager has control over the timing of capital calls and distributions.

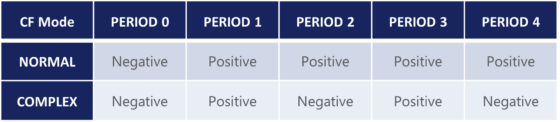

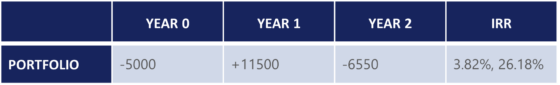

However, IRRs are not without their pitfalls. Under a normal cash flow investment pattern, they serve as a valid performance measure. However, frequent changes in cash flow patterns can result in multiple IRR solutions. The maximum number of IRRs possible is equal to the number of cash flow sign changes. In the complex scenario below, there could be 4 potential IRRs.

Additionally, there is a common misconception that a profitable deal will always yield a positive IRR, a loss will result in a negative IRR, and breaking even will produce a zero IRR. Although often true, these are guidelines rather than strict rules. An example is a deal that loses money but still shows two positive IRRs². Both of which are incorrect. The key takeaway is that cash flow sign changes necessitate a detailed examination of IRR results.

IRRs – OK, BUT WHICH ONE?

Use case drives method.

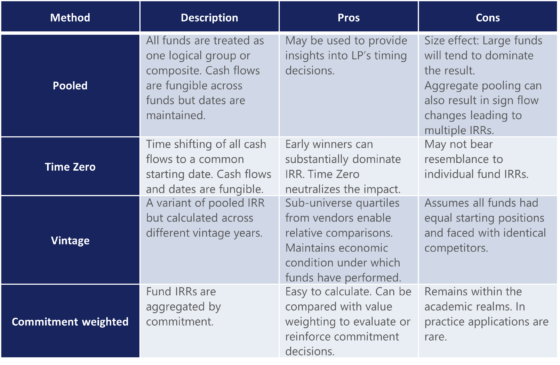

We did mention that IRRs are a useful performance measure for alternatives. The nature of alternative investments in asset owners goes beyond direct fund allocations. Multiple strategies are possible within an alternative asset class. For example, venture capital, growth equity and buyout are common under Private equity. Each strategy could invest in several funds.

How can fund IRRs be aggregated at the strategy and asset class level? There are multiple methods of aggregating IRRs, and each has its own relevance. A quick summary of four methods is provided below³.

Source: Meradia

Calculating additional IRRs might serve another useful purpose for further analysis. For example, vintage year weights can be applied to benchmark returns and then calculating performance differences. If the portfolio committed more (or less) capital to outperforming vintages relative to the benchmark, then this will typically generate positive (or negative) timing alpha⁴.

BENCHMARKS – IS THERE A STANDARD INDEX FOR AN ASSET OWNER FUND?

The challenge Asset Owners face is how to align investment decision making to customized benchmarks that reflect the stages in the process. Constructing the ideal benchmark is the underlying task that comes with complex decisions. Asset Owners are tasked with examining fund performance against multiple economic factors and benchmarks.

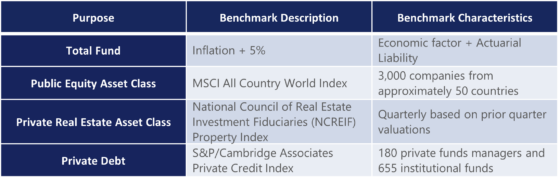

Consider the possible benchmarks employed by Asset Owners for different use-cases:

Source: Meradia

In-line with return measurement methodologies, Asset Owners have numerous options when benchmarking the Total Fund or underlying asset class levels. Most funds incorporate exposures into nearly all asset classes and involve a variety of private deal structures. This necessitates applying multiple methodologies when benchmarking across fund allocation and investment selection decisions.

Total Fund Targets

Total fund benchmarking often takes a different approach from asset class or strategy-specific benchmarks. This is driven by the macroeconomic nature of total fund management which requires separating allocation decisions from investable portfolio targets. Consequently, one or more mitigating adjustments are typically introduced:

- Smoothing Short-Term Movements: Mitigating the impact of short-term fluctuations in an index to maintain a long-term perspective

- Adjustment Factors: Accounting for inflation, expenses, and currency impacts to ensure the benchmark accurately reflects the fund’s performance relative to its objective.

By carefully balancing these factors, asset owners can construct benchmarks that provide more accurate and meaningful comparisons, helping them make informed decisions that align with their long-term goals and short-term objectives.

Asset Class Benchmarks

Asset Owners often leverage traditional approaches to benchmark asset classes against similar investment exposures. This process is straightforward for public markets, given the long history of using market-based indices. For example, the asset owner might choose to compare its diversified global equity portfolio to the MSCI All Country World Index, which tracks global stocks from nearly 3,000 companies across approximately 50 countries.

Private asset classes benchmarking is less uniform. To meet investor demands, index providers are rapidly publishing new benchmarks. For example, Private Credit Index options have grown to support deal types, credit quality, and regionality. There is also an increased focus on improving data transparency into private market indices. Today hundreds of indices are available to support the vast nuances of private market assets, including some adjusted for lagged valuations like those CA. Furthermore, some platforms support the creation of custom private asset benchmarks based on actual fund data which can be tailored based on a wide range of fund characteristics, further expanding the number of available benchmarks.

Private market index providers, like asset owners, face practical constraints due to lagged valuations published on a less frequent basis generally quarterly. Auditing the value of a building or private company is not something that is done on a daily basis today. Aligning the source and timing of valuations is a fundamental step in performance measurement and benchmark relative analysis. Discrepancies in valuation methodologies or mixing providers can lead to return inconsistencies. The same holds true regarding the frequency of private market benchmarks that report index performance for prior quarter-ends on a three-month lag.

Few asset owners adjust dates on lagged asset pricing or index valuations for official book of record reporting. Adjusting the effective date on valuations to remove the lag in valuations is certainly possible, and some index providers and consultants advocate for this alternative view of results. Time adjusted views are rarely used for official fund reporting but are useful to explain anomalies. For example, performance measurement teams leverage adjusted valuations to ensure portfolio attribution is representative of investment decisions rather than timing differences.

While some Index Providers and Asset Owners restate data adjusted to remove the lag in valuations and benchmarks, there appears to be consensus by the industry in the standard practice by General Partners and their auditors to report in arrears for nearly all private asset classes.

CONCLUSION

Return measurement and benchmarking is not a standardized practice for Asset Owner, however return type usage models are beginning to take hold on when to use an IRR or TWR. Operations teams and index data providers are both motivated to generate more accurate results data in support of more insightful portfolio and benchmark-relative performance attribution and ex-post risk analysis.

The ongoing challenge for the industry will be to accelerate lagged valuation cycles wherever possible, define a consistent total fund return methodology, add index transparency, and align benchmarks to the investment decision-making processes employed by chief investment officers and investment boards.

Stay tuned for these insightful papers in our Asset Owner series.

- Does GIPS have a place amongst asset owners? If so, how can it be leveraged?

- Do established attribution models accurately capture the value delivered by various stakeholders in the portfolio construction process? If not, do we have an alternative?

HOW MERADIA CAN HELP

Meradia consultants guide Asset Owner through complex methodology decision analysis and operational transformations. From establishing return & benchmark construction processes to building operations based on best practices, Meradia delivers on projects across trading, investment operations, performance analysis, and data management.

References

¹A quote attributed to Harry Markovitz.

²Alternative Investments – An Allocator’s Approach by Donald Chambers, Keith Black & Hossein Kazemi.

³Inside Private Equity – The Professional Investors handbook by James M Kocis, James C Bachman, Austin M Long & Craig J Nickels.

⁴Private Portfolio Attribution Analysis – Gregory Brown, Frank Ethridge, Tyler Johnson, Tom Keck

Download Thought Leadership Article Solution Design, Strategy and Roadmap Performance, Risk & Analytics Asset Owner Jose Michaelraj, Richard Mailhos info@meradia.com

info@meradia.com