The first paper in our ‘Performance is Data’ series emphasized the significance of data management in investment performance services. In this second outing, we pivot to performance transformations.

Specifically, we present the business drivers that propel investment operations transformation, discern why a large proportion of digital transformation fails, and present a new approach with its differentiating aspects.

WHAT ARE THE KEY DRIVERS OF TRANSFORMATION TODAY IN INVESTMENT PERFORMANCE SERVICES?

Successful transformations balance expansion with efficiency.

There are several factors to perfect investment management and data strategy, including industry, macroeconomic, and firm-specific factors that could potentially end in large-scale transformations. Within a new market, firms and their asset managers tend to focus on expansion but can also maximize their risk management and other operational risks in the new space by taking advantage of modern technology and operations.

While these investment performance services can only improve, they can also present an opportunity to consolidate and reorganize investment operations, investment strategies, and more systems.

Regardless of what initiates the transformation, a new ecosystem needs to be designed. Modified data flows, governance and enhanced service levels must all be considered. And, while it can seem there are redundant applications when firms begin considering solutions, Meradia helps uncover the appropriate vendor for this new undertaking. Vendors should improve your operations, data analysis, and more. Not all of this can happen in-house.

Investment performance services and Investment management companies can extend their help with front-to-back outsourcing platforms. This helps firms scale by reducing their burdens of sourcing, normalizing, and enriching data all through investment operations.

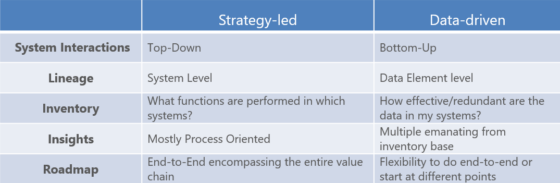

WHAT DOES A STRATEGY-LED TRANSFORMATION LOOK LIKE WITH PROFESSIONAL INVESTMENT OPERATIONS MANAGERS ON YOUR SIDE?

A strategy-led transformation, while beneficial, is heavily prone to increased cost and project extension risk.

Most commonly, transformations are strategy-led by investment operations consulting firms (like Meradia) and executed in three parts:

- Current State Assessment: It commences with understanding the current state through interviews and structured questionnaires. Process and data flow diagrams are created to realize the critical pain points.

- Benchmarking & Analysis: After that, a series of collaborative brainstorming sessions help identify potential options through data strategy. The firm is placed in the context of its peers and industry best practices.

- Target State Definition: A target operating model with a multi-year roadmap is defined. The list of projects that progressively enhance the current state is detailed. Critical Success factors are established. Scorecards are defined. Progress of investment operations is monitored periodically, as operational efficiency.

Under such an approach, project risk tends to arise in the following ways:

- Experience-based decision-making: There is no substitute for experience. However, quickly obtaining a detailed understanding of a firm’s landscape is often difficult. Comprehension limits pose issues; subsequently, the information required to make decisions is missing.

- Inflexible Structure: Firmwide transformations necessitate concerted discussions with various business units and IT departments. Some departments could undergo significant developments quickly, altering the proposed model. Substantial effort is required to understand the changing landscape, assess the impact, and tweak the model. Costs soar, and timelines expand.

- Delayed Benefits¹: The benefits of integration in a large transformation program become more visible with increased connections and bridges between systems. It could take anywhere between 24-36 months to realize this. The longer the drag, the higher the risk.

WHAT DIFFERENTIATES A DATA-DRIVEN TRANSFORMATION?

Data-driven transformations unearth greater detail to overcome blind spots.

If firms or portfolio managers are looking more into a metric-driven approach, they will want to go the data-driven transformation route. There is a comprehensive inventory listing all structured and unstructured data elements from vendor products to data stores to API libraries, and reports are then created based on all of this in the assessment phase. Most transformations like this require quite a bit of technical skills and overall cleanup on their existing IT systems, so make sure you work with an experienced team that can handle putting out those modern capabilities.

A firm-wide data inventory provides a basic understanding of your landscape. It can answer questions such as:

- Which system(s) contains the most critical data?

- Where does the bulk of reporting reside?

- How modern is my firm’s landscape? (API vs. Feed distribution)

Data collection is only the first step. Enriching the inventory and summarizing can lead to further insights. Here are some examples:

- Which systems curate new data?

- Which data points are used in decision-making?

- How redundant is my data across systems?

- Which is the gold source(s) for each data domain?

A group of enterprise data often yields insightful trends that may elude detection without a holistic examination. Statistically, a staggering 70% of organizational transformations falter, frequently attributable to the deficiency of granular data informing the definition of such initiatives. The thorough appraisal of this data does more than merely clarify the existing operational matrix—it also unveils prospective pathways for the envisaged state. This data-centric approach does not replace but rather enhances the existing strategy-driven methodologies, offering the pivotal advantage of the ‘data perspective.

WHAT BENEFITS DO DATA-DRIVEN TRANSFORMATIONS PROVIDE FOR INVESTMENT OPERATIONS?

Data-driven transformations increase confidence, deliver value early, and reduce risk.

Transformation agents can now glean the inventory and derive value by providing a jump-start into understanding a firm’s system landscape.

- Validate interview responses before designing the target state – Enabling educated timeline predictions.

- Find the magnitude and usage of Excel vs. different applications – Uncover potential to solve the spreadsheet chaos and ascertain investment operations maturity.

- Obtain a consolidated but in-depth view of the system landscape – Greater visibility into the extent of technical debt and relative usage of vendor products.

- Recognize the similarity of data between various systems – Mix and match to supply alternate solution options. Interesting views of the new ecosystem could appear. Informs Scoping and Impact Analysis.

- Know completeness of data – Data quality issues are understood sooner rather than later.

- Differentiate pass-through and calculated data – Define targeted business requirement documents (BRDs) with mapping info.

- Understand reports and dissemination data points – Develop a business case for report rationalization and accelerate the design of APIs or vaults.

It tends to broaden understanding and fill experience gaps.

CONCLUSION ON DATA MANAGEMENT AND WORKING WITH ASSET MANAGERS

Working with a strategy-led transformation can give businesses the competitive advantage to grow their assets while keeping clients happy. The biggest transformations require relevant data, technology, and information on the subject matter.

A data-driven approach with enriched inventory could serve as a valuable resource by promoting data literacy, filling knowledge gaps, resolving challenges, and overcoming skill dependencies. It complements a strategy-led approach by helping overcome its pitfalls. It sets the stage for quick wins, without which the success of your transformation might be at risk.

Data-driven approaches require strong governance right from the start. Up next, we discuss the importance and benefits of investment performance services and performance-led data governance initiatives.

info@meradia.com

info@meradia.com