“As of March 2025, Artificial Intelligence heavyweight Open AI is valued at $300 Billion. Nvidia Corp, one of the largest facilitators of AI, has surpassed Apple to become the world’s most valuable company. More than 25% of all code at Google is now AI generated.” (Channel Insider, WSJ, Fortune)

Though seemingly unbelievable, these headlines are accurate and effectively summarize the current AI landscape worldwide. The Tech Industry is flourishing, but have the tentacles of AI percolated into the financial world? Yes! All of the world’s ten most prominent investment firms by assets under management now leverage AI extensively in their day-to-day operations. Financial institutions and investment firms have not only welcomed AI but embraced it as a transformative force. From revolutionizing trading strategies and risk assessments to enhancing customer service and operational efficiency, AI has woven itself into the fabric of finance.

How is this AI revolution different from the internet during the dot com bubble?

On closer inspection, one can draw numerous credible parallels between the rise of AI today and the rise of the internet in the 90s. In those days, everyone wanted to build and host a website, taking every possible service online without any mindful thought. Similarly, at least 67,200 companies are working in the AI space as of 2024. Both these events have heavily rallied stock market indexes around the world. A ‘gold rush’ mentality pervades both booms, where companies rush to implement the latest technology, often without fully considering long-term sustainability or regulatory challenges.

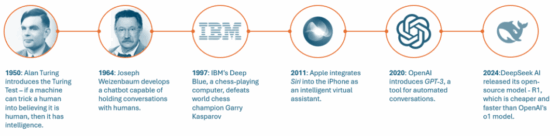

The instability in the AI market became more pronounced when DeepSeek AI released its open-source model, DeepSeek-R1, which was 20 to 50 times cheaper to use than OpenAI’s o1 model, depending on the task. This development highlighted inflated valuations in the market and led to a significant impact on tech stocks. For instance, Nvidia’s stock experienced a historic single-day loss of $600 billion in market value following DeepSeek’s announcement.

This initial wave of excitement in AI has led to widespread speculation and increased scrutiny as investors and regulators alike work to understand and manage the potential risks and rewards. Discover the future of AI in finance and dive into this article to explore how AI is revolutionizing front, middle, and back-office functions. Learn about the leading platforms, their real-world utility, and how Meradia is steering businesses toward more innovative AI integration.

Setting the stage: AI is older than you think!

Over the past couple of years, many of us have incorporated OpenAI’s ChatGPT into our lives in numerous ways. For some, it has become indispensable for daily communication, problem-solving, and productivity. Others turn to it occasionally, leveraging its capabilities to complete tasks more efficiently and streamline workflows. Regardless of how frequently it’s used, ChatGPT has proven to be a remarkably versatile resource, adapting to diverse needs across personal, academic, and professional domains.

While AI has seen widespread acceptance and integration into everyday life in recent years, its conceptual roots trace back to the mid-20th century. The idea of creating machines capable of mimicking human intelligence first gained prominence with pioneering theories from visionaries like Alan Turing, who proposed the concept of a “universal machine” capable of solving problems through computation. This early vision has since evolved through decades of research and innovation, culminating in transformative tools like ChatGPT that demonstrate the real-world potential of AI today.

AI is the simulation of human intelligence in machines that are designed to think, learn, and perform tasks typically requiring human cognition. AI systems are programmed to process information, recognize patterns, make decisions, and adapt their behavior based on input and experience. The goal of AI is to enable machines to function autonomously, solve complex problems, and interact with their environment in ways similar to humans.

How is AI impacting the financial investment industry?

AI is transforming the finance industry by enhancing efficiency, improving decision-making, and uncovering new opportunities. From investment management to fraud detection, AI-powered systems are reshaping how financial institutions operate, making them more agile and customer-centric. The ability of AI to analyze vast amounts of data, identify patterns, and make predictions is driving innovation in areas traditionally reliant on manual processes and intuition.

- Forecasting and Analysis

- In Investment Management, AI is used to develop sophisticated algorithms that can analyze market trends, forecast asset performance, and optimize portfolios. Hedge funds and asset management firms leverage machine learning models to identify trading opportunities and execute trades at lightning speeds. AI also enables robo-advisors, which provide personalized investment advice based on individual risk preferences and financial goals.

- Fraud Detection and Risk Management

- Fraud Detection and Risk Management have seen significant improvements with the adoption of AI. Machine learning models can analyze real-time transaction data to detect anomalies indicative of fraudulent activities, such as unusual spending patterns or unauthorized access. Similarly, AI enhances credit risk assessment by evaluating non-traditional data sources, such as social media activity or transaction histories, providing more accurate and inclusive lending decisions.

- Customer Experience

- AI is also transforming Customer Experiences in banking and financial services. Chatbots and virtual assistants powered by natural language processing (NLP) handle customer inquiries efficiently, offering 24/7 support and personalized financial insights. Moreover, AI-driven Expense Tracking and Budgeting tools empower individuals to manage their finances more effectively. As AI continues to evolve, its role in finance will expand further, driving innovation while raising questions about ethical implications, data privacy, and regulatory compliance.

- Trade Settlement, Compliance, and Data Reconciliation

- AI is revolutionizing middle and back-office Operations in financial institutions, particularly in trade settlement, regulatory compliance, and data reconciliation. With AI-powered automation and analytics, these traditionally labor-intensive and error-prone functions are becoming more efficient, accurate, and scalable. AI-driven tools process and match large volumes of transactions across different systems, flagging discrepancies for human review. This significantly reduces manual effort and accelerates settlement times, enhancing operational efficiency. Machine learning algorithms also improve the accuracy of these processes over time by learning from historical data and identifying patterns in recurring exceptions. AI plays a crucial role in Regulatory Compliance by automating the monitoring and reporting of activities. NLP models extract and analyze information from regulatory documents, ensuring that firms comply with ever-evolving standards. Tools like anomaly detection identify unusual patterns in transactions or workflows, aid in anti-money laundering (AML) and Know Your Customer (KYC) procedures. By automating these tasks, firms reduce compliance risks and associated costs.

How leading Investment Firms are using AI in the “Next Gen Operating Model”

Several leading investment firms are integrating artificial intelligence (AI) into their operations to enhance efficiency, decision-making, and client services. For instance:

- The world’s largest asset manager, BlackRock, has developed the Aladdin platform, an AI-driven system that assists in risk analytics and portfolio management. Aladdin analyzes vast datasets to provide insights into market trends and potential risks, supporting informed investment decisions. (Financial Times)

- Similarly, Goldman Sachs employs AI across various facets of its business. The firm utilizes machine learning algorithms for trading strategies, risk management, and client interactions. By analyzing historical data and market patterns, these AI systems help Goldman Sachs optimize trading decisions and manage risks more effectively. (Business Insider)

- Morgan Stanley has also embraced AI, enhancing its wealth management services. Through a collaboration with OpenAI, Morgan Stanley has developed AI tools that assist financial advisors by providing quick access to relevant information and insights, improving client service and operational efficiency. (Business Insider)

These examples illustrate how top investment firms leverage AI technologies to maintain a competitive edge, improve operational processes, and deliver enhanced client value.

My thoughts on AI for the future of Investment Industries

AI evokes mixed feelings for me. On the one hand, it represents an extraordinary leap in technology, with tools like ChatGPT becoming integral to various industries and daily activities. On the other hand, I see much of the current AI landscape as a bubble. A significant number of companies are essentially offering little more than wrappers around existing AI models without unique value propositions. These entities are unlikely to survive in the long term. However, as a transformative tool, AI is here to stay and will become even more prevalent across industries.

One undeniable outcome of AI adoption is the reshaping of the workforce. The automation of tasks will lead to a reduced need for human labor in many roles, driving an increase in efficiency. At the same time, individuals will need to adapt by evolving their skill sets to align with AI-driven processes. This transition won’t eliminate jobs in their entirety but will change their nature, creating demand for skills in managing, training, and augmenting AI systems. It’s essential for workers to embrace these changes and for companies to adopt AI early to avoid falling behind in a rapidly advancing race.

Regarding AI’s impact on financial markets, I remain skeptical about its ability to revolutionize stock market predictions. The stock market operates on a zero-sum principle – if one party profits, another incurs a loss. Universal AI-driven accuracy in predicting market movements would nullify this dynamic, as the widespread adoption of predictive algorithms would lead to inefficiencies where no one truly benefits. The hype around AI-powered trading and market predictions seems unsustainable, and the stock market’s dependency on AI companies will likely diminish over time.

Despite these nuances, the strategic adoption of AI is crucial for organizations to remain competitive. While the hype around AI will inevitably fade, its role as a tool to enhance productivity, drive innovation, and transform industries is undeniable. Companies that adapt early and thoughtfully will set themselves apart, utilizing AI not just for its capabilities but as a foundation for sustainable growth in an evolving economic landscape.

What Meradia and I are doing to leverage AI:

Meradia’s consultants are uniquely positioned to help organizations navigate the transformative landscape of Artificial Intelligence (AI) and automation. With deep expertise in investment management operations and technology, our consultants can guide firms in identifying AI-driven opportunities to enhance efficiency, optimize workflows, and achieve strategic objectives. From designing tailored AI implementation strategies to integrating innovative tools, we ensure our clients stay ahead of the curve in a competitive and evolving industry.

We assist asset managers, wealth managers, and other financial institutions in evaluating their current processes and identifying areas where AI and automation can deliver the greatest value, such as data reconciliation, risk management, or client reporting. By leveraging its expertise in system selection, implementation, and project management, Meradia ensures the seamless integration of AI solutions while mitigating operational risks.

Moreover, Meradia’s insights into regulatory compliance and change management make it an invaluable partner for firms navigating the complexities of AI adoption. The firm can assist in building robust governance frameworks and ensuring compliance with evolving regulations. By combining industry knowledge with a client-centric approach, Meradia empowers financial institutions to harness AI responsibly and effectively, transforming challenges into opportunities and enabling long-term success.

Contact us today for a more AI-driven tomorrow!

- AI is revolutionizing middle and back-office Operations in financial institutions, particularly in trade settlement, regulatory compliance, and data reconciliation. With AI-powered automation and analytics, these traditionally labor-intensive and error-prone functions are becoming more efficient, accurate, and scalable. AI-driven tools process and match large volumes of transactions across different systems, flagging discrepancies for human review. This significantly reduces manual effort and accelerates settlement times, enhancing operational efficiency. Machine learning algorithms also improve the accuracy of these processes over time by learning from historical data and identifying patterns in recurring exceptions. AI plays a crucial role in Regulatory Compliance by automating the monitoring and reporting of activities. NLP models extract and analyze information from regulatory documents, ensuring that firms comply with ever-evolving standards. Tools like anomaly detection identify unusual patterns in transactions or workflows, aid in anti-money laundering (AML) and Know Your Customer (KYC) procedures. By automating these tasks, firms reduce compliance risks and associated costs.

info@meradia.com

info@meradia.com