Asset Owners¹ play a pivotal role in the institutional side of the investment landscape, utilizing capital markets to fulfill the long-term needs of beneficiaries. Their objectives are intricately tied to liquidity requirements and investment horizons, overseen by stakeholders such as Boards, Trustees, and Investment Committees. Given the diverse asset classes involved, a blend of internal and external management strategies is commonly employed to execute investment policies effectively. This combination necessitates external due diligence, multi-asset class strategies, and regular rebalancing to maintain risk thresholds, thereby crafting a distinctive operational environment for asset owners.

This landscape piece seeks to explore the multifaceted world of asset owners, from the fundamental business drivers to the intricate operational challenges they encounter. Beginning with an overview of their unique objectives and governance structures, we dive into the specific challenges faced, with particular emphasis on navigating private markets and external manager processes. Through a blend of insights and practical experience, we aim to present nuanced solutions, industry use cases, and best practices tailored to the dynamic landscape of asset ownership.

Business Drivers

While it’s undeniable that pension funds, sovereigns, endowments, and family offices represent distinct business types from asset managers, it’s equally true that geographical and regulatory demands place specific constraints on each. Given these factors, one might question the validity of grouping them under a single umbrella. However, upon closer examination, common characteristics emerge among these diverse entities. Consequently, their operational challenges often exhibit striking similarities. Our analysis of the asset owner landscape underscores the prevalence of these shared business drivers.

Higher Allocation to Alternatives – According to industry projections, private credit is anticipated to witness a surge in allocations, surpassing traditional investments like private equity, venture capital, and real estate². This shift is driven by the search for assets offering private equity-like returns with lower risk, as highlighted in our Industry outlook report³.

External Management of Assets – Asset owners often leverage external managers’ expertise to manage specific asset classes or geography. While cost and internal pressures prompt some to bring management in-house, the forecast remains evenly split between internal vs external management⁴.

High Incidence Towards Basic Performance Outsourcing – Many asset owners, such as pension funds in the United States outsource performance to custodians for official reporting. However, analytics generation for portfolio management and monitoring remains predominantly within the firm.

Sophisticated Benchmarking – The complexity of public and private asset mix with overlays necessitates sophisticated blends of target factors and comparable benchmarks. Substitutions and benchmark specific override calculations are common practice.

Complex Account Structures – Multiple strategies and varied account structures require consolidation into a single portfolio view for comprehensive return and risk exposure analysis. Some mandates involve numerous portfolios nested at multiple levels, sometimes exceeding eight levels.

Layered PM Decisions – Asset owners often have separate departments managing specific asset classes and a distinct department overseeing the total fund view. Decisions outside asset classes, such as liquidity rebalancing and currency management, significantly impact the overall fund’s return and risk profile.

OPERATIONAL CHALLENGES

The above drivers create significant operational challenges:

Valuing Lagged Assets – This complicates valuation mechanisms, as private funds typically provide quarterly valuations. Aligning daily public asset valuations with infrequent private valuations requires proper adjustments and transparent reporting.

Processing External Manager Statements – The task of processing external manager statements is daunting due to disparate formats and a lack of scheduled report delivery timelines, hampering operational efficiency.

Managing Multiple Books of Record – Handling multiple books of record, especially when performance is outsourced, becomes a substantial data management challenge.

Maintaining Deep Hierarchical Account Structures – Complex account structures necessitate sophisticated roll-up calculations. Layered fee structures and claw back clauses may require smoothing and adjustment mechanisms to achieve a comprehensive total portfolio view.

Calculating Blended Benchmark Returns – Benchmark calculations must account for differing valuation, rebalancing, and reporting lag parameters. Challenges arise with zero-weighted blends and asymmetrical trees, even for advanced performance calculation engines.

Measuring Value of Federated Decision-Making – Accurately measuring the value added by various departments and stakeholders within the firm is hindered by federated decision making. Strategic and tactical allocation policy weights and related performance calculations often do not seamlessly integrate with vendor products.

Designing Robust Data Architecture – Robust data architecture is imperative for managing long horizons, ensuring efficient inception-to-date return and analytics calculation and storage. It requires significant capital expenditure. Archaic batch processes impede operational efficiency.

In this first paper of the asset owner series, we will explore the valuation challenges posed by higher allocations to private markets, external asset management, and the complexities of managing multiple books in greater detail.

PRIVATE MARKET VALUATIONS

Policies guide valuation choice – private equity and private credit warrant separate treatment.

Private investment vehicles employ non-traditional investment strategies to offset risk and create alpha for investors. Investment performance calculations are standard, yet they challenge traditional investment performance in how and when the ingredients are sourced.

In private equity, success stems from strategic acquisitions and long-term value creation in companies. Valuing true private equity assets requires time due to their gradual realization of value.

Private credit, with its floating-rate loans and lower volatility compared to public markets, necessitates frequent valuation for effective monitoring⁵. Although performance at inception and maturity is relatively straightforward, valuations during the investment horizon often require modeling mechanisms.

Private market funds are valued quarterly and provided to investors with a lag. Preliminary valuation often, but not always, precedes a final valuation. It is not unusual for private equity managers to be reporting, for example, December 2023 valuations during June or July 2024. This delay, compounded by lagged valuation, presents hurdles for timely performance reporting. Operational challenges such as negative valuations, late pricing, and revisions further complicate return calculations in private markets.

Late Pricing – Private equity valuations are often delayed, lagging reporting periods by three to six months.

Preliminary and Final Pricing – Private equity managers typically publish preliminary valuations, followed by final pricing. As valuations evolve from preliminary to final stages, performance numbers change. Significant changes may trigger restatements if new returns exceed materiality thresholds.

Negative Valuations – Infrequent valuation updates in private equity can lead to situations where a holding, previously valued at cost, may register negative valuations after being sold for a substantial gain.

THE CASE FOR ESTIMATED VALUES

Estimated values are a potential choice for performance reporting for the right set of portfolios.

Firms adopt strategies to address challenges created by lagged valuations. The method chosen should be tailored to the audience. The use of estimated values is prevalent among single family offices or large endowments. This method closely reflects performance and valuation as newer information becomes available. One can argue that this method provides transparency. Proxy data from benchmarks, such as those published by Cambridge Associates or Hedge Fund Research (HFR Indexes), is commonly used until preliminary valuation data is available. While benchmarks are an imperfect proxy, those reflecting vintage year and overall market conditions provide a better representation of changes in the current period.

Roll-forward pricing is another method used when final data is not yet available. This method is particularly common among pension and sovereign wealth funds. However, its efficacy diminishes over long time horizons when private investments’ periodicity diverges from the rest of the portfolio.

In summary, benchmarks provide initial estimates, replaced by preliminary valuations, and ultimately finalized valuations This process relies on systems supporting multiple restatements, with transparent communication of material performance differences being essential best practice.

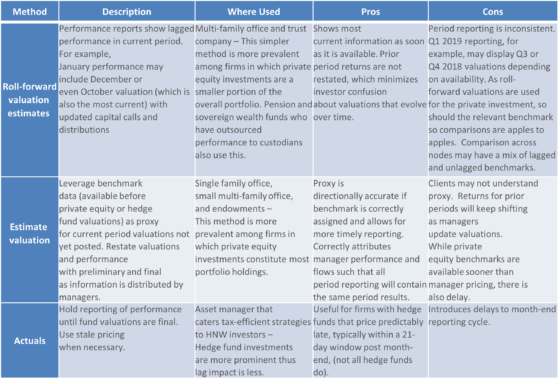

VALUATION OPTIONS: PROS AND CONS

Consider multiple valuation methods depending upon use case and stakeholder type.

The following table presents strategies that address the challenges arising from late pricing. All methods presented are widely used in the market. It is considered best practice for firms to clearly state which method has been applied and what happens to the subsequent and final valuations in reporting disclosures.

Source: Meradia

EXTERNAL MANAGER IMPACT

Employ machine learning tools to process manager statements efficiently.

Depending on the agreement with the asset owner, External managers often deliver information with delays, reporting exposures incrementally before providing actual positions and pricing. These lags can range anywhere from five to upwards of 30 days, creating challenges in timely reporting and necessitating the reopening of prior periods for restatement.

The core principles of efficient processing are timeliness, accessibility, and quality. Applying these to alternative investments, such as private equity, can feel like collecting data from a locked safe. Operational teams may struggle to digest the contents, as general partners (GPs) do not follow a standard reporting template when providing capital statements to the limited partners (LPs)⁶.

Efforts by organizations like The Institutional Limited Partners Association (ILPA) to advocate for global standardization have yet to eliminate the persistent variety of data formats. While all required reports are received before the deadline, the industry still lacks streamlined schedules.

However, technology tools have enhanced alternative data capabilities. Flexible duration triggers allow for automation even when files do not follow a schedule, the ability to extract data from PDFs and embedded images improve accessibility. Defined validation rules further increase data quality, facilitating the bridge between manager statements and accounting and performance systems.

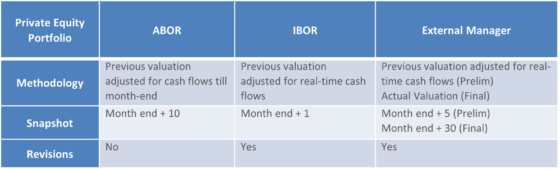

MULTIPLE BOOKS OF RECORD

Delineate book of record for returns/analytics generation. Building a PBOR is valuable.

When asset owners outsource performance calculations to custodians, they typically rely on the Accounting Book of Record (ABOR) for performance calculations. However, many asset class departments maintain an Investment Book of Record (IBOR) to cater to portfolio manager preferences and ensure timeliness. Additionally, managers may provide valuation numbers with both preliminary and final estimates, further adding to the complexity. This situation effectively results in three books of record, each based on varying valuation methodologies, snapshot generation times, and consideration of revisions.

Source: Meradia

Each perspective on performance leads to slightly different performance returns and, consequently, any analytics, potentially causing fragmentation and reduced stakeholder confidence. Unfortunately, most accounting systems lack support for asset owners with multi-strategy mandates, overlay managers, sub-advisors, benchmarks, and policy targets embedded in the investment decision-making process⁷.

A Performance Book of Record (PBOR) is a unified platform that addresses data weaknesses and enriches information to produce a comprehensive performance evaluation. PBORs enables accurate rate of return measurement across all assets under management, supporting various portfolio flavors, benchmarks, and aggregates to generate actionable insights.

CONCLUSION

Asset owner performance is highly dependent on the quality of the diverse accounting inputs, particularly in navigating the complexities of valuing private markets. The varied methods employed often lead to challenges interpreting reported analytics. Firms choose methods based on customer sophistication and the capabilities of supporting platforms. Utilizing fit-for-purpose tools reduces the operational complexity of manager statement processing and adds transparency for timely investment reporting. Implementing a Performance Book of Record (PBOR) framework can effectively alleviate the data challenges of handling multiple books of record.

In upcoming papers, we will delve into key topics including:

- What are the important considerations to handle asset class and total level benchmark calcs? Can complex fee structures be handled seamlessly?

- Do established attribution models accurately capture the value delivered by various stakeholders in the portfolio construction process? If not, do we have an alternative?

- Does GIPS have a place amongst asset owners? If so, how can it be leveraged?

Stay tuned for the next papers in our Asset Owner series.

REFERENCES

¹CFA institute Blogs – https://blogs.cfainstitute.org/investor/2018/02/20/the-seven-kinds-of-asset-owner-institutions/, Accessed on 4/1/2024.

²https://www.institutionalinvestor.com/article/2cko05eweh3eh5l6ut43k/portfolio/allocators-plan-to-bump-up-investments-in-private-credit-next-year, Accessed on 4/8/2024.

³Meradia Industry Outlook View – Meradia’s 2024 Industry Outlook – Meradia

⁴Source: BNY Mellon/OMFIF operating model survey https://www.bnymellon.com/us/en/insights/evolution-public-asset-owners/portfolio-management-internal-external-or-both.html, Accessed on 4/9/2024.

⁵CFA Institute Research Foundation – An introduction to Alternative Credit.

⁶Meradia Paper: Cracking the Code on Automating Alternatives Data Management

⁷Meradia Paper: What is a Performance Book of Record (PBOR), and Why is it Important to Leverage Data as an Asset and Driver of Growth?

Download Thought Leadership Article Solution Design, Strategy and Roadmap All Meradia Asset Owner Jose Michaelraj info@meradia.com

info@meradia.com