The investment management industry comprises a diverse group of asset owners and managers that differentiate themselves by traversing countless new products and private market vehicles across forever-evolving global financial markets. There was a time when the trade blotter and accounting book differed by days or weeks and clients received reports quarterly – somehow that was fine! Today, investment managers and asset owners face complex daily asset administration and reporting cycles.

Most managers, regardless of investment strategy, create and store massive amounts of data every day. Fund strategies, client holdings, rates of return, benchmark relative analytics and other subsets of data are combined to provide investment insights. While these needs were primarily driven by portfolio managers, today’s regulators seem to be wanting more. Asset management organizations call this function many different things, including back and/or middle office, but the platform upon which these teams depend to produce critical information has not been well defined by the industry. This paper outlines why “Performance Book of Record” (PBOR) is an appropriate term for these platforms; and why PBORs are an efficient way investment managers can harness enterprise information to better leverage data as a growth driver.

THE HISTORY OF PBOR

When the term Performance Book of Record first appeared in 2014, many people thought of it as just a marketing ploy to promote financial technology. This skepticism was understandable given that it was a very different concept from the other book of record used by managers. Many were quick to raise challenges about the concept. The most common centered around a few basic questions:

- Why are the accounting books of record (ABOR) and investment books of record (IBOR) not enough?

- How can a performance system be considered a book of record?

- Is a PBOR different than a performance measurement system?

These are all good questions, and the answers will help better define what a Performance Book of Record is; and why it is important for sophisticated asset management and asset owner organizations to consider in future operating models.

The first step toward building a good definition is clear: we need to delineate between an Accounting Book of Record (ABOR) and an Investment Book of Record (IBOR). Once this is established, we will begin to define the Performance Book of Record (PBOR). [Table 1]

When you consider the need for performance measurement ready data, both books of record fall short of modern-day investment managers. Accounting is generally considered a back-office function that offers limited direct benefit to business teams without intervention from middle office, risk and performance teams. These teams take raw accounting data to form the enterprise view that consolidates and enriches information on portfolio holdings, strategic overlays and market benchmarks to answer demanding questions from clients. These processes run nightly but usually require daily intervention by performance analysts to ensure results are reliable. Data management and performance systems, along with the teams that use them, are collectively a good definition for a Performance Book of Record. PBOR can also be viewed as the current processes used by an investment manager to produce verified time-series results to investment boards and clients.

WHY ARE TRADITIONAL PERFORMANCE SYSTEMS INADEQUATE?

Performance teams combine data from multiple sources of accounting books, security masters, analytics, underlying exposures, market indices, and strategic benchmarks with relevant firm and client data. Not all of this data is easily stored in traditional performance systems, nor do most managers leverage performance systems this way. Beyond generating returns, performance teams integrate disparate data to build informative analytics that fuel conversations between asset owners and managers. Furthermore, most organizations observe an increase in reporting requests that are shifting from the simple “How did my total portfolio perform?” to “Where are my exposures misaligned with agreed strategies?” and “How can I better hedge my risks?” These demands go beyond what most performance measurement systems can support today. Underlying exposures are a good example of data that goes beyond accounting system capabilities, posing challenges for many performance systems.

Performance operations also involve deep data governance activities to hold together the layers of data needed by a firm to generate meaningful analysis on complex investment strategies. For example, lagged versus non-lagged valuations can require two completely independent sets of performance results. Other challenges to traditional performance systems include managing multiple versions of accounting data for the same investment (market priced and notional economic exposure priced); or incorporating external private market assets together with public market portfolios for a total asset owner’s view of investments and later in top-down attribution analysis.

Governance over all internal and external sources of data involved can be mind-numbing. Where are the hidden data gaps? How are breaks being closed, and under what controls or audit trails? Investment operations and technology teams have worked together and traditionally integrated performance systems, market data solutions and risk services into unified databases and reporting tools to support this entire process. This common enterprise platform has become a critical system for most asset management organizations and deserves a clear industry definition.

Performance solutions alone cannot solve enterprise problems and so most are not considered a PBOR. The investment management industry has been prioritizing resources to unify data and better govern how information is used across organizations for years. This trend has greatly improved investment data solutions and data governance as a practice, while the cost of data storage continues to fall and cloud solutions gain traction. Oddly, these trends have also allowed firms to maintain multiple legacy systems for the same corporate functions, only perpetuating operational risks. In many cases, this is due to growth in a specific asset class, division, or a merger or acquisition and the need to address a burning operational issue. The existence of multiple performance systems in many ways demanded the need to define PBOR as a way to rationalize performance results into an official enterprise information hub.

WHAT EXACTLY IS A PBOR?

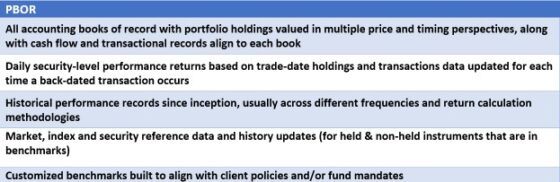

If most performance systems are not a Performance Book of Record, then what exactly is a PBOR? Let’s first consider the vast sums of investment data used in official or externally reported performance results. Most firms grow performance data archives across multiple systems and business functions. Here are some of the key characteristics of performance measurement ready data and the history stored in most performance databases. [Table 2]

Supporting multiple sources of accounting and reference data comes with significant operational demands. Portfolio holdings, for example, can be defined in multiple valid ways based on T+1, T+90, non-lagged adjustments, fair value priced, specific foreign exchange rate, regional fund pricing and notional exposure basis. Poorly governed data can quickly become a nightmare and lose the trust of your internal and external clients. Let’s consider some of the challenging requests performance teams fulfill in the course of normal reporting cycles:

- Align security characteristics for a fund and 2,000 benchmark constituents.

- Provide contribution to return from each underlying exposure of an ETF over the year-to-date period.

- Rank fund share class against peer groups and compare private market strategies across vintage years.

- Model risk through scenario analysis and stress testing for a fund or proposed strategy.

- Report an alternative view of results based on investment manager flags for use in compensation analysis.

- Track benchmark data usage and manage index licensing agreements across multiple providers.

Each of these activities relies on robust and verified information as well as tools to navigate large amounts of security-level data. The collective enterprise processes that support all these functions is the best description of a Performance Book of Record. Perhaps the adage “you won’t know what you’re looking for until you find it” applies here. A PBOR also comes into light when you consider all of these complex functions carried out by performance and other middle office teams.

A Performance Book of Record solution should centralize data and rationalize operational functions with robust time-series performance analysis and risk management capabilities. A PBOR should enable greater confidence over critical business functions through more uniform and consistent processes. Successful PBOR deployments result in more efficient investment operations and long-term cost savings- both universal goals for investment managers under the ongoing pressure to reduce fees and expenses. The managers of the future must determine how to generate growth at lower operating costs in order to survive.

The level of performance data necessary to maintain on a daily detailed attribution analysis is very resource-intensive and time consuming. Most accounting systems feed daily positions and cash flows into a performance calculator, but this is generally considered insufficient. IBOR accounting and other recordkeeping systems continue to try and solve elements of the PBOR challenge but fail to address all performance data issues. Some cannot provide back-dated updates for each impacted day in the time period while others cannot support lagged valuations or restatements where multiple versions of the truth must be maintained historically based on alternative prices. Unfortunately, nearly all accounting systems fall short in support of asset owners with multi-strategy mandates, overlay managers, sub-advisors and layers of benchmark and policy targets embedded in the investment decision-making process.

A Performance Book of Record is the collective platform that addresses data weakness and enriches information to produce performance returns across all assets under management. PBORs should support rate of return measurement based on daily security and sub-security level data. This is the key to generating actionable information. Comparing a strategy to an index over extended time periods, eliminating residuals caused by pricing differences and other data anomalies are more common than most realize. A reliable, daily time-weighted rate of return by its nature is a fundamental building block for all attribution and ex-post risk analysis. Without a strong PBOR data strategy, the benefits of security-level attribution and multi-factor risk analysis can be elusive when regular data issues are visible in reports.

WHO CAN BENEFIT FROM A PBOR?

The Performance Book of Record concept is relevant for the entire investment management industry in that it reinforces the principles of fiduciary responsibility. All types of institutional investment managers, including asset owners, insurers, asset managers and wealth managers, require reliable information when making investment and risk mitigation decisions. A PBOR empowers deep levels of analysis for each investment strategy, but it should also be considered as an effective tool for organizing enterprise data. Legacy data platforms struggle to manage fundamental data and rarely enable informative analysis and consistent self-service reporting. As the industry moves toward cloud-based solutions, it is appropriate to address the data and operational weaknesses in disconnected performance measurement, analytical and reporting tools.

Investment industry solution providers seem to agree! A quick web search on PBOR shows it is gaining traction. Most industry service providers, including top custodian and fund administrators, now promote that they offer a Performance Book of Record. Many performance measurement technology vendors also use the term on their websites. The concept is used to position a wide array of services and technology solutions. Most define their PBOR solution as one that addresses the need to consolidate data, generate performance returns and support strategic analysis. Asset servicing vendors are not alone in using the term “PBOR”. Multiple asset managers have adopted the term and are currently working to establish Performance Book of Record platforms. These projects have become a priority for many firms when updating performance and data management systems simultaneously.

Asset managers and asset owners are acutely aware of the operational challenges outlined above. Many have enterprise data governance or data-is-everyone’s-responsibility style programs underway to address weaknesses or fortify operations. Focusing these industry problems into a Performance Book of Record is a useful strategy because the complexities of enterprise data governance are central to the goals of Global Investment Performance Standards (GIPS). The usefulness of defining this holistic problem set as PBOR is tied to the key question most investors ask their advisors, “How did my portfolio perform?” The core metrics in this question are, of course, a daily performance return on each investment, the related currency impact and, if possible, a view into underlying risks. Calculating a reliable investment return seems trivial, but performance teams find this to be a complex problem to solve for global investment managers.

WHY IS A PBOR IMPORTANT RIGHT NOW?

- Accounting records do not provide data that is completely performance measurement ready.

- Managing asset performance since inception is a fiduciary responsibility.

- Comparative benchmark data in line with performance results is a fundamental asset owner expectation.

- Overwhelming amounts of security-level data being managed for investment portfolios is only expected to grow more challenging in the future.

- Performance systems and service providers typically fall short.

Most firms do not budget or prioritize system rationalization while growing a new fund product. Frequent mergers and acquisitions compound the problem and should only be expected to increase as management fee and operating margin pressures rise. These realities explain why redundant, manual, and divergent processes are so common across the industry. Compounding this challenge are unaddressed legacy problems such as outdated technology and the wide use of Excel-based procedures. Performance and risk teams are particularly vulnerable with large numbers of the Excel workarounds to address time-sensitive requests. Excel and manual procedures are rarely retired and continue to be an enormous operational risk that plagues the industry. Without a PBOR strategy, workarounds like Excel worksheets and direct SQL queries will only increase over time.

Investment operations and enterprise data management programs demand enormous budgets, yet it is unclear if firms are getting what they pay for. By defining a more rational target state that incorporates a Performance Book of Record, investment managers are more likely to deliver consistent performance and analytics capabilities to internal and external clients.

WHAT IS NEXT FOR PBOR?

As adoption ramps up, the industry will naturally improve on the definition for PBOR. Certainly, changes like shifts to cloud-based solutions will impact how these platforms are built and deployed. Many firms are beginning to use a snowflake database architecture to build broad-based data platforms. These projects often leverage analytics engines like R and Python to enable highly-flexible analysis and data science research. At the same time, data aggregators and asset servicing providers are building Data-as-a-Service offerings to solve some of the operational challenges associated with a Performance Book of Record.

There is clear momentum across the industry as investment managers realize the importance of data as a competitive differentiator. As we see more and more data scientists joining asset managers, the Performance Book of Record is a robust and effective method to harness enterprise data as a growth driver.

This article was originally featured in The Journal of Performance Measurement Summer 2021 issue, Volume 25: Number 4. For a complimentary subscription to The Journal of Performance Measurement, please click here.

Download Thought Leadership Article Solution Design Performance, Risk & Analytics Asset Managers, Asset Owner, Service Providers & Outsourcers Richard Mailhos info@meradia.com

info@meradia.com