Where does the restrictive nature of vendor data contracts originate?

Market data vendors typically have data as their primary revenue-generating product. Raw data from multiple sources is cleansed, refined, and enriched to provide a valuable ‘Packaged Construct’ (Security Pricing, Index, etc.). There are several cost models employed by the market data vendors. Some factors that feed into these models are:

- Magnitude – Number of users

- Scope – Purpose of usage

- Geography – Territory applicability

- Consumption pattern – Internal consumption purposes (passive strategy research) or external (client reporting)

A firm’s intent to reduce the market data costs during initial licensing may constrain the usage within the firm. Such limited usage also makes it hard to generate economies of scale with data consumption. Data originated within the market data vendors landscape as a packaged product could lay the foundations for a service within the firm’s premises. For example, index data from multiple vendors could be brought together into a centralized system. It may then redistribute the whole or a portion within a service management framework for the entire firm – total level return service for performance users, constituent level return service for attribution requirements and a hedged return service for portfolio managers.

Also, another group may want to use data that is constrained to one specific area – what happens when system owners unaware of the covenants acquire the restricted data and send to another group or system? Typical consequences for such contract breaches vary from a warning, to a fine, proof of cease and desist, a new contract or statement of work to open the scope of usage. Either way, most firms face an increase in cost as a one-off or recurring basis – not to mention the difficult conversations with legal and compliance departments.

Does it sound familiar to what you have experienced? You’re not alone.

An investment manager could have many of these contract types active at one time. Keeping track of the various restrictions, usage of the data and by whom is often an onerous task placed on a small group of individuals or handled on an infrequent basis as situations arise. In addition, the return on investment for tracking usage according to contract provisions is small to non-existent. These tasks do not feed profit or return, thus are not usually funded to a high degree.

Teams embark on a quest to manage their usage according to the contractual restrictions and reporting requirements. But they find it daunting. A lack of technology to handle the tracking, inability to effectively manage many contracts accompanied with its related restrictions and insufficient number of resources to accomplish this task present a compelling challenge. As mentioned above, events that occur can often be handled ad-hoc without formal approval or business sponsorship. This can stem from a lack of business realization of the importance of complying with vendor contracts and responding to audits and compliance inquiries.

Is there a solution in sight?

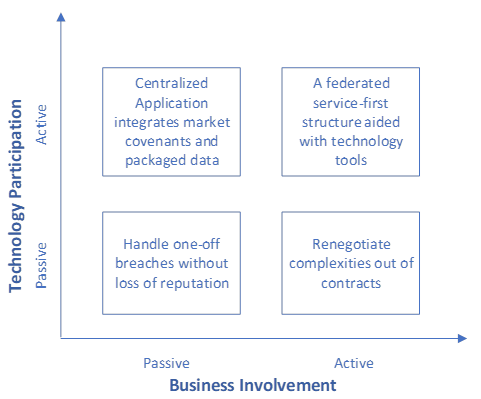

Many firms are faced with data being used beyond the scope of licenses, potentially unknown usage within the company, and business areas attached to their data. So how do they begin to solve the problems? Each firm is different in size, organizational design, and culture. Broadly, we present four options for consideration (see FIGURE 1):

a) Handle one-offs:

Once vendor contracts are signed, ensure appropriate communication of data usage restrictions to a core team comprising of key business and system personnel. Establish policies and procedures to ensure the core team approves use cases involving market data. The success of this method depends on the efficacy of the individuals and is highly unlikely to provide quick outcomes as a thorough examination might be required. When breaches occur, commence negotiations with the vendors to establish resolution steps resulting in reduced fines and minimal reputational loss. Contracts could also be renegotiated to allow for the data usage.

b) Renegotiate complexity:

Invest in a contract renegotiation exercise. Peruse the entire list of contracts signed by the firm over the years. Carefully catalog the contracts to identify vendors where cost is high and whose contracts pose the maximum business risk. Obtain the data management requirements for the near future and commence discussions to increase the scope but reduce the contract complexity. Custom contracts are typically possible when volumes are high, and this might not be a viable option for small- to medium-sized firms.

c) Develop a centralized application:

Commence a technology-led approach that attempts to uncover the key clauses concealed in the market data contracts and integrate with packaged product data. This involves marrying unstructured with structured data. Document management systems exhibiting natural language processing capabilities could play a significant role in reducing development time. Recent technology advancements have also brought to light digital management software – an evolving space that could offer significant benefits. Business personnel will be actively engaged until the initial roll-out of the centralized application, after which their involvement gradually reduces. This is typically a long-haul effort and not recommended for most firms.

d) Define a federated mechanism:

Most problem-solving frameworks view this complex maze from a data origination standpoint. A services-led approach may present an interesting alternative where it starts to look from the other end of the spectrum, i.e. a consumer-centric standpoint that includes both internal and external stakeholders. In this case, business services delivered by different departments that utilize market data must be identified. Key use cases and market data covenants are juxtaposed to determine the intersection of what should be managed closely.

Let’s illustrate with an example. A performance department provides benchmark analytics services to internal and external consumers. This necessitates utilizing index level and constituent returns information. Although index levels can be freely distributed, constituent returns must be ring-fenced and kept within the firm. The firm could distribute the data externally without knowing the adverse impact. This approach requires a sustained effort from both business and technology stakeholders and is better suited for large firms.

FIGURE 1

Source: Meradia

FROM REACTIVE TO PROACTIVE

Picking any one of the above choices allows you to move from reactive to proactive. This is essential to control your situation and add value to your firm. The cost can be high for companies that wait or don’t devote business or technology resources. Audits and penalties from market data firms and exchanges can increase costs, sometimes significantly. A greater risk could manifest in the form of a reputational loss. To avoid these financial risks, it is best to assess your current state, and identify how to improve your operations in this area. Ultimately, mitigating operational risks reduces financial risks.

HOW MERADIA CAN HELP

Meradia has helped investment firms optimize their data governance, management, and tracking for over 25 years by conducting evaluations, assessing options, and integrating process improvements and technology.

Download Thought Leadership Article Conversion and Implementation, System Rationalization Data and Technology Asset Managers Andrew Jacob, Jose Michaelraj info@meradia.com

info@meradia.com