CHALLENGES TO ATTRIBUTION: A MENAGERIE OF METHODS

Performance and risk attribution are tools we develop explicitly to serve a single, well-defined purpose: measurement of the manager’s process. A MAC manager’s portfolio – the end product of that process – contains a complex mix of equity, fixed income, hedged and un-hedged currency and illiquid asset exposures, constructed using a wide variety of methods. Attributing the value added by these processes is a challenge that carries a high degree of difficulty.

The most apparent stumbling block is that of clashing methodologies. Equity, fixed income, currency and hedging all – to some degree – have some ‘standard’ attribution templates. Our goal is not to separately measure individual sleeves in the portfolio; rather how to bring them all together to get a coherent picture of the whole.

These incompatibilities become even more severe when illiquid asset classes – private equity, real estate, infrastructure, et alia – are added to the mix. For a variety of reasons, performance of these assets is typically measured using an internal rate of return method – mathematically irreconcilable with the time-weighted method used for traditional classes. Further complications arise from the vagaries of illiquid asset valuation: lack of comparables, low frequency and lagged valuations are difficult to integrate rationally with attributions sourced from daily pricing.

Disparate classification schemes – or “drill-downs” – present another hurdle. Clearly, we want to have a drill-down in the equity sleeve – say, by sector – that is different than that of the fixed income sleeve, perhaps by rating. But can our attribution engine support this asymmetry?

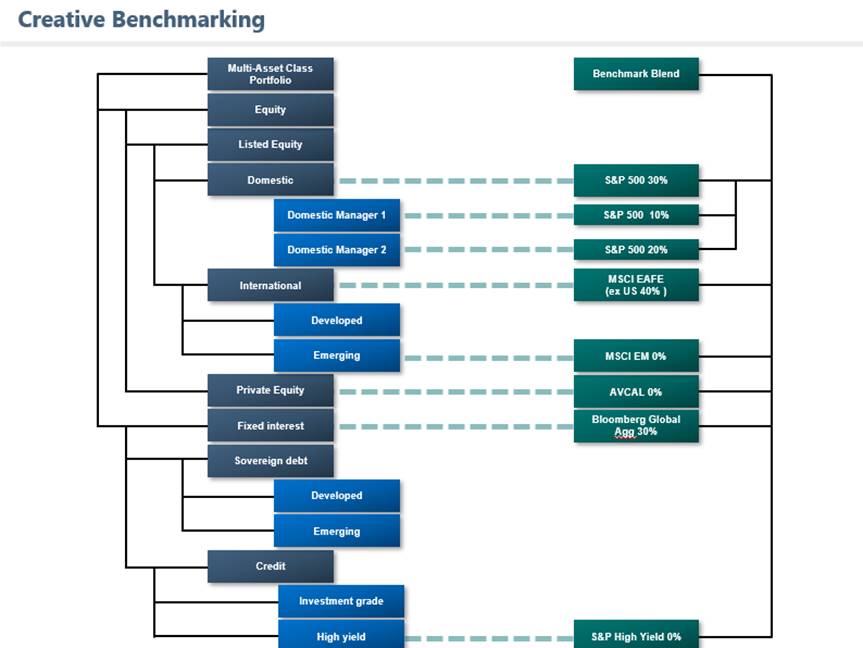

Benchmark definition presents difficulties as well. Meaningful benchmarks for a MAC portfolio rarely exist in the wild. We are therefore tasked with constructing a bespoke benchmark, often blending a number of single-class, published indices into a relevant baseline. Out-of-benchmark bets must also be considered, when appropriate indices are not available, or otherwise not included.

Finally, integrating risk into the attribution framework is mandatory. The most attractive feature of MAC is the return/risk of uncorrelated risky assets; measuring this strategic source of value is critical.

‘CUT-AND-SEW’: THE TRADITIONAL APPROACH

Our first means of addressing these challenges is one that’s been employed many times over many years – in fact, the basic concept will be recognizable to anyone with experience in ‘balanced’ portfolio attribution.

The cut-and-sew method begins by measuring the top-down allocation effect derived from weighting of the top-level asset classes. Drilling down into each class, we proceed with distinct methodologies suited specifically to that class. For example: Brinson-Fachler attribution for domestic equity, Karnosky-Singer for international, and key-rate duration for fixed income. Within illiquid classes, we could even present an IRR method, (although, without being able to tie it up to a TWR used elsewhere).

Though vanilla versions of this approach have long been in service, more sophisticated MAC managers have recently been expanding beyond traditional practice, developing finer and more precise ways of tuning cut-and-sew attribution.

The drill-down capabilities of any MAC attribution must be sophisticated, supporting multiple, asymmetric levels with methodology-specific schemes. Going even deeper, a great number of choices can be made at the classification node level to further attune the analysis to specific strategies:

- Specification of distinct methodology and return-decomposition models – such functionality implies distinct report columns by node

- Utilization of strategy, or decision-based attribution methodologies within the node

- Weight scaling, to sum to 100%, or to the parent weight

- Attribution effect scaling, to explain the total management effect or only the parent selection effect

- Look-through, by depth or by container asset type

Another dimension within which we find MAC managers innovating is benchmark construction and tuning. Highly complex blends, with zero- or partially-weighted members, mapped to specific portfolio sleeves can be designed to isolate relevant attribution effects within the portfolio. An example of such a benchmark construct, and its relationships to the portfolio might appear as below:

Clearly, developing an attribution incorporating some or all of these node-by-node features is a formidable task. Even using a tool capable of supporting such complexity, care must be taken to ensure that meaningful, intentional results are being produced.

PROCESS-BASED ATTRIBUTION: A DIFFERENT TAKE

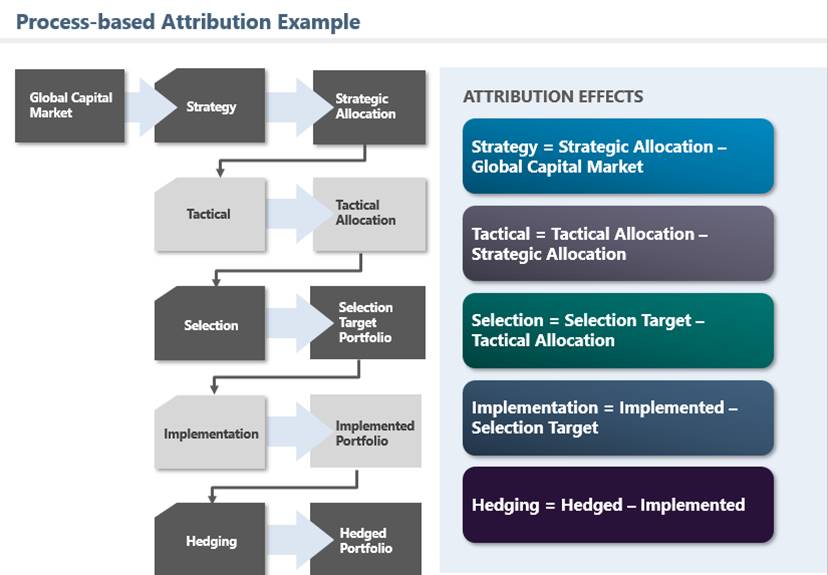

Lately, we’ve been working with managers taking a more direct approach to MAC attribution. Process-based attribution begins by analyzing the investment process itself, rather than the ex-post portfolio resulting from it. First, we break the process down into steps: distinct, separable increments which together – serially or in parallel – comprise the transformation of the benchmark or universe into the constructed portfolio. For many managers, these process steps are already well documented in RFP response decks.

Next, we measure the value added by each step as the difference between the before- and after- returns of the notional portfolio achieved by executing that step’s process. An example of a typical process-based attribution might appear as below:

Going a step further, individual efforts can be further decomposed using step-specific methods: e.g., strategy- or decision-based techniques.

CONCLUSION

Our previous examinations of the Multi-Asset Class phenomenon considered motivations, benefits, and practices of MAC investing that distinguish successful practitioners from their more traditional counterparts.

In this exploration of real-world rubber meeting the road, we found a formidable array of complexities that might, at first consideration, seem to preclude any practical implementation of attribution. Instead, during our time spent developing successful solutions with client partners, we’ve found that MAC attribution can be a tractable and valuable tool – indeed, an indispensable one – for firms employing such strategies. In all cases, it has been the collaboration between Meradia’s creative talent, broad experience, and managers’ comprehensive, rigorous understanding of their construction process that has been the key to successful achievement of our clients’ MAC objectives.

Download Thought Leadership Article Solution Design Performance, Risk & Analytics Asset Managers, Asset Owner Meradia Consultant info@meradia.com

info@meradia.com