A GROWING DEMAND FOR THE OCIO MODEL

An Outsourced Chief Investment Officer (OCIO) model enables institutions to delegate all or some of the investment decisions and operations to a third-party provider. The practice of delegating to an OCIO has increased steadily during the past decade. According to Pension and Investments, outsourced investment management programs had a growth rate of 9.4% yearover- year, data ending March 31, 2018. The growth has been fueled by plan mandates, plan derisking programs and innovative outsourcing of defined benefit plan assets. Further, Cerulli Associates is predicting that assets under management for OCIO providers could reach $2.3 trillion by 2022 – up from $1 trillion in 2016.

WHAT DOES AN OCIO MODEL LOOK LIKE?

The services provided by an OCIO may include full or partial responsibility for services such as:

- designing a customized investment strategy

- selecting managers for specific investment styles

- dealing with day-to-day investment operations

- interacting with fund administrators.

The degree to which an institution commits itself to the delegation of their investment discretion and the operational methodology determines the right operating model. Some institutions and committees may find it best to delegate essentially the entire investment function to the OCIO provider, retaining approval of only the highest-level portfolio policies such as the setting of strategic asset allocation targets and policy development. The key is to understand what the institution wants to keep in house; and more importantly, what the institution can support.

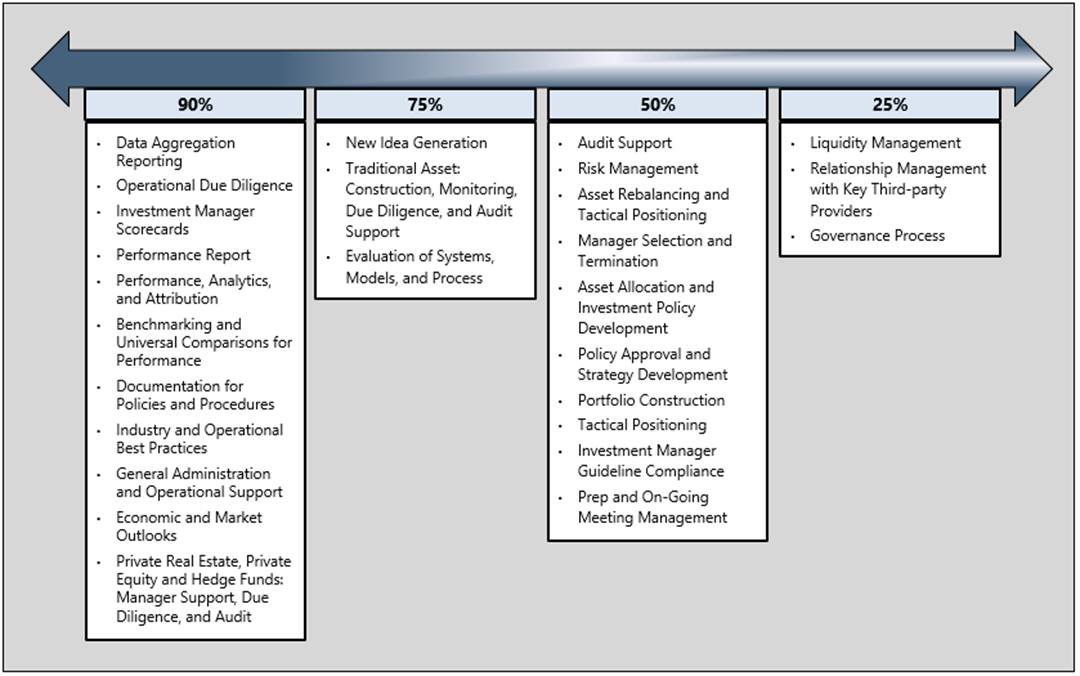

The table on the following page represents a sample “hybrid” OCIO model. The percentages equate to the level of support for which an Institutional firm may leverage an OCIO provider.

CONSIDERATIONS FOR SELECTING AN OCIO

At a high-level, an OCIO should deliver the following value and services:

- Expertise in areas including governance, education, transition management, and leadership. The client should act like a cofiduciary partner and complement the client, especially if the firm chooses to keep some services in-house.

- Skill to articulate and explain how ideas are sourced and evaluated.

- Ability to demonstrate their approach to building a portfolio, selecting managers, and their research philosophy.

- Full transparency regarding services, operations, and fees. The OCIO must act as a fiduciary for their client and safeguard against excessive fees.

- A team that fully-understands the needs of the client, with available specialists who understand nonprofits, defined benefit, and defined contribution plans. Team stability and longevity are crucial for building and maintaining deep relationships.

- A documented proven track record of meeting objectives.

WHY SHOULD YOU CONSIDER AN OCIO MODEL?

- Investment Committees are facing more challenges than ever. This includes the increased scrutiny of portfolio performance, growing concerns about reputational risk, and challenges of navigating changing regulations. The investment landscape is continuously changing, and an OCIO provides the experience and knowledge to navigate through these changes.

- Investment Committees want to optimize their time. Outsourcing allows committees to focus on strategic portfolio issues and empower day-to-day decision making to professionals who can optimize portfolio performance based on their firm’s strategy. OCIOs support clients in determining an optimal division of labor for internal operations. Services range from outsourcing investment strategy and manager selection, to full fiduciary and operational responsibility.

- Portfolios need real-time management. Outsourcing allows committees to delegate the timely implementation and administration decisions to a professional team that is held accountable for the portfolio’s results. It provides access to top investment management professionals and investment strategies across asset classes. OCIO providers will do the leg work to fully-investigate a manager and ensure they are the right fit to meet clients’ needs.

- Complex investments require specialized skills. Sophisticated committees who have experience with alternative asset classes recognize that such portfolios cannot be overseen with limited internal resources. Many OCIO providers specialize in alternative assets such as hedge funds, private equity, and venture capital to provide sophisticated solutions for plans. They have open accessibility to research people and data, including direct client web access to databases and research reports. OCIOs can implement and support alternative assets.

- Staff can be difficult to attract and retain. Building and maintaining a diverse and talented in-house investment office can be challenging and costly. An outsourced investment office provides stability to the investment management process in a cost effective way.

TRANSITIONING TO AN OCIO MODEL

There are several key steps to transitioning to a target state OCIO model including:

- Formally documenting the current state of the investment department operating model including clear roles and responsibilities. This is a critical base for establishing a target state model.

- Determining which functions can remain in-house, or if all of them should be outsourced. Consider if a best-of-breed model or a hybrid model should be employed. Several operational functions require transparency as well as a cost-effective execution.

- Identifying a technology model that supports a wide spectrum of investments and trading strategies, secure and integrated data, and disaster recovery program with ample back-up.

- Defining a target state operating model prior to the implementation to ensure that resources and initiatives are appropriately prioritized, future state requirements are met, and the implementation is efficiently executed.

- Thoroughly documenting the future state OCIO model including roles and responsibilities, oversight and governance tenets, defined processes, rules, reporting, and key controls.

- Defining a roadmap, implementation plan, and project oversight for establishing and transitioning to an OCIO model that fits the business.

HOW MERADIA CAN HELP

Meradia has proven methodology and skills to:

- Strategically assess your current operating model and future state integration with OCIO

- Develop RFP and conduct vendor selection

- Implement OCIO model

info@meradia.com

info@meradia.com