Many firms face the challenge of balancing growth and profitability. Traditionally, the most common solution for growth, actual or desired, was to simply add staff. Today, as margins compress, employees are being asked to increase productivity and do more than ever before. Workloads are growing, yet resource allocations are shrinking, leaving management teams in a difficult position. There is a tension between adding staff and expense, and over-burdening employees, risking burnout and resignations.

Although this phenomenon could exist across the enterprise, we attempt to examine it in this whitepaper through an investment performance and operations lens. Supported by findings from a recent survey we conducted, we start by describing the major paths through which firms expand their business. We then move on to illustrate why most traditional approaches to handling growth have resulted in sub-optimal operations. Finally, we provide a framework with demonstrable use cases to prove that ‘Efficiency at Scale’ is not an oxymoron.

About the Survey

Meradia conducted a survey in the first quarter of 2023 to gather intelligence regarding the way asset management firms handle growth. In total, thirty-one respondents completed the survey representing firms ranging in size from less than US$1 billion to over $1 trillion and from less than 100 employees to over 5,000.

Growth Avenues

Large-scale growth (not including organic growth in a firm’s client base) in the asset management industry tends to originate in three ways:

- Venturing into new assets such as alternatives

- Entering new markets/geographies

- Through mergers and acquisitions

Of the firms responding to our survey, nearly half (45%) experienced growth as a result of expanding into new asset classes. The same amount (45%) also experienced significant growth through mergers and acquisitions. Just over a quarter (26%) of the firms grew by entering new client markets or geographic regions.

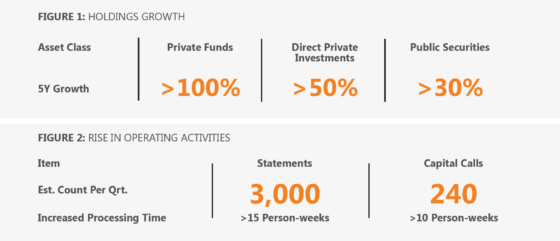

Alternative investments are expected to produce half of industry revenue in a few years, fueled by growth across investment strategies and a blurring of the lines between public and private capital1. Alternative assets often put a strain on investment operations due to the quantity, complexity, and diverse nature of these investments, as well as the manual tasks associated with them e.g., statement retrieval, capital call processing, and suspense account management. The advancement of alternatives is something we expect to continue and there is a clear impact on the workload required to support it. An example from a mid-size OCIO below illustrates the rise in processing volumes and corresponding manual effort.

Although the strain would be felt across all asset classes to varying degrees, alternatives were singled out because capital calls and statements processing are manual in most markets, consequently requiring greater resource consumption.

Geographical expansion is another route pursued by some firms. Many asset managers in developed markets, for example, foray into international geographies as there is faster growth witnessed in Latin America and APAC². Unique investor requirements, regional nuances, integration with additional market intermediaries, and compliance with domestic regulations are often required in such cases.

While the first two areas – expansion into alternative and new geographies – require sustained internal effort, mergers and acquisitions represent an inorganic method for achieving quick growth. Asset management M&A activity hit a record high in 2021 with 392 transactions. 2022 saw a bit of cooling but still hovered around 300.³

The benefits of M&A are achieved through synergies or access to complementary markets or market segments. As far as the former is concerned, they mostly accrue through the consolidation of systems and processes. While an increase in AUM presents an optimistic path to external stakeholders, the challenge of supporting that growth often rests with various internal stakeholders.

How do firms handle this?

Conventional Approaches

Firms traditionally tackle this growth challenge using one or more of the following methods:

Buy tools: Intuitively, utilizing technology seems to be a strong argument for solving the problem of growth, and it was the highest ranked approach in our survey. The productivity paradox, however, has been well documented in many instances where an all-in technology view has been taken. Research has indicated that IT expenditures and top performers need not necessarily go hand in hand. In a large study of the financial results of 7,500 U.S. companies, the top performers tended to be among the most tightfisted. The 25 companies that delivered the highest economic returns, for example, spent on average just 0.8% of their revenues on IT, while the typical company spent 3.7%⁴.

Increased investments in IT beyond a certain point may have little to no effect on economic performance. Technology is a great tool, but business process fitment and alignment are key as we illustrate in later sections. Lack of a rigorous dissection and fitment could result in sub-optimal value derived from technology.

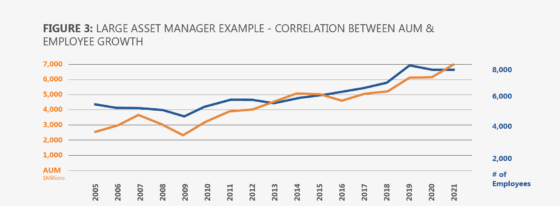

Add people: Adding more people to support existing tools and processes typically results in increased non-revenue generating fixed costs. The problems with this approach are two-fold. Firstly, there is a significant administrative effort that involves extensive coordination with many departments of the firm. Secondly, the cost of maintaining employees during a downturn is high and so are the reputational and social impacts of letting them go. Most importantly, this is not a scalable model. Surprisingly, however, adding human resources was the third highest ranked approach in our survey.

Reduce service levels: After encountering massive growth, firms often attempt to reduce costs by trimming down their service levels and at the same time we have seen this in mature firms that have increased the headcount of performance teams. Yet the relationship between services & headcount is non-linear. Abstaining from providing bespoke reporting services and training stakeholders to self-fulfill certain requests are common examples. This approach produces small, tactical benefits where certain fringe requirements get simplified, but one needs to be careful as sub-process optimization could lead to process sub-optimization. It can be challenging from a reputational perspective to pull back services and, not surprisingly, this was the lowest ranked approach by respondents to our survey.

Outsource burdensome functions: Outsourcing itself is not new to the industry as technology and some middle office services have been successfully outsourced for many years. But the scale with which it is done has surged recently. Firms tend to outsource their operations, either performance only or even larger functions, and focus on their ‘core competencies’ like portfolio construction and management. Outsourcing providers broadly service asset managers in two ways: building large-scale monolithic platforms, or tightly integrating a suite of systems. While the former is usually achieved by a single service provider, the latter can require partnerships with multiple vendors, which arguably increases scope of due diligence.

Outsourcing brings many benefits to the asset manager but also introduces its own set of challenges. We discuss the benefits of outsourcing, the challenges⁵, and how to evaluate those service offerings in separate articles⁶. Here, we focus on approaches to increase operational efficiencies to support growth from an inward-looking standpoint. It is perhaps the challenge of managing and overseeing the outsourcer that resulted in this ranking fourth out of the five approaches proposed in our survey.

Increase effort: Existing teams are expected to support increased growth by working longer days. We do not see firms deploy this approach as a long-term model but rather utilize it as a stopgap mechanism while any of the other approaches above take shape. That said, increased effort from the same resources quickly leads to employee burnout. The resulting loss of intellectual capital and institutional knowledge can range from inconvenience to paralysis. Working longer and harder – at least in the short term – appears to be an easy lever to pull or pedal to step on and ranked second highest in our survey.

Meradia’s Framework

For the operating model to be efficient, it rests on four important pillars (ranked in the order they have been employed by survey respondents):

- Streamlined Process

- Optimized Organizational Structure

- Effective Tools

- Strong Controls

1. Streamlined Process

Efficient business processes accentuate the benefits of technology. Streamlined processes help improve productivity, reduce costs, and provide transparent communication. Streamlined, however, doesn’t mean simple, it means fit for purpose. With efficient processes, operating and maintenance costs should not linearly increase with growing volumes. Meradia has guided firms to establish quality checks and define appropriate tolerance levels, within performance ecosystems. Tolerance levels are challenging because setting a tight tolerance could result in false positives and extend project timelines and costs, but a broader tolerance will fail to catch important issues. Rather than defining a single, one-size-fits-all tolerance threshold, best practice dictates to establish thresholds based on investment strategy, function, and level. This ensures that operations personnel focus on the most meaningful breaks and channel their time toward important research activities. Adding people, tools, and controls will be insufficient without addressing the process.

Fit-for-Purpose Tolerance Levels: Meradia played the lead role in the evaluation of a multi-asset attribution platform for a global active asset manager. Asymmetrical structures, multi-layered decision trees, and benchmark sourcing from market data providers exacerbated the comparison complexity during the Proof-of-Concept phase. Thorough understanding of fund-of-fund strategies, attribution algorithms, and market volatility helped Meradia establish meaningful tolerances across 15,000+ data points on multiple dimensions – returns, attribution effects, time periods, and nodes (grouped investments). As a result, outliers were reduced by half, enabling the Operations team to focus on actual discrepancies.

2. Optimized Organizational Structure

Optimized organizational structures increase the quality and timeliness of decision making. As many asset management firms venture into international markets, agility becomes key. Processes and systems are established specifically to the local geography in which they must operate. The tendency to tap into the intellectual capital across the enterprise is lost as time to market receives the utmost attention.

As a result, disparate organizational structures and redundancies often crop up over time. These become a drag on profits as cost pressures grow. Federated structures that centralize certain functions while isolating others can benefit international firms. In the performance space, Meradia has assisted global firms with carving out key data management tasks to centralized teams while leaving core performance analysis (for example, composite returns not aggregating properly or attribution residuals not tying out) to domestic teams.

Alternatively, Meradia has also assisted firms with consolidating their functions and achieving economies of scale. For example, performance teams extend their responsibilities to include either reconciliation services and/or client reporting within their ambit.

An optimized organizational structure often starts with identifying common activities. Key questions that arise are:

- Are these activities better performed by consolidation?

- Do we need to merge multiple departments?

- Should we split a large department into smaller, manageable ones?

Inevitably, growth requires a change to the organization’s structure, and how that is handled depends on a firm’s primary goals. Meradia has helped clients evaluate and redesign organizational structures to ensure that roles and responsibilities are clearly defined and properly aligned. Below is an example of Meradia’s real-world solution to an optimization problem.

Restructuring Departments: Meradia’s role as a performance process consultant helped reorganize functions for a global custodian, whose pre-calculation checks, return investigations, and custom parameters handled by multiple teams caused low utilization and poor service levels. Members across U.S., Europe, and India ascertained the performance readiness of data coming from accounting systems. The portfolios were split by geography throughout the performance workflow. Performance teams that commenced validations in the morning could produce returns by midday, at best. An account-centric view was transformed into a function-led approach. Meradia centralized the quality checks, set up dedicated data management teams, and established federated performance workflows. Consolidating checks from several locations improved data quality and, taking advantage of time differences across global operations, enabled returns to be available in the mailboxes of U.S. and European colleagues prior to the start of their workday.

3. Effective Tools

Proper IT fitment maximizes business value across the firm. Technology is a powerful tool only when used for the right purpose. Inappropriate selection of tools to solve a functional need will pose a severe strain on the operating model. Use cases should be carefully studied to properly align with the right tool in the technology stack. For example, fund fact sheets are better served by tightly integrating reporting engines with performance systems, rather than custom built applications. On the other hand, custom wrappers could come in handy where vendor products fall short; for example on regional expectations and regulations.

Suitable Calculator: A large asset manager was utilizing a home-grown application for calculating eight risk statistics. Enhancement plans commenced to build ten additional statistics. Meradia persuaded the client to switch to a ‘Buy’ approach and led the selection process to choose a risk platform distinct from the performance engine. Although performance and risk are tightly related, processing constructs required to perform the calculations efficiently are different for each. Time series models and parallel processing mechanisms significantly reduce processing time⁷.

Excel-reliant infrastructures are still common in many firms. Meradia has seen sophisticated calculation methods and return reconciliation done in spreadsheets, as well as many non-mathematical tasks such as process checklists. “If it isn’t broken, don’t fix it” arguments are often raised. We respectfully disagree. Excel-laden processes offer little to no visibility into how tasks are progressing⁸. In our opinion, such structures could break down (e.g., corrupted files) at any moment.

Robotic process automation (RPA) and business process automation (BPA) tools are viable alternatives for easing such problems. RPA tools help in end-to-end automation of a single task while BPAs are more strategic and address workflows. The key difference between RPA and BPA is that BPA can require judgment inputs, collaboration, and decision-making. It is important to remember, however, that these tools are not a panacea. Meradia has assisted firms to ascertain fitment of these toolsets within the investment operations landscape⁹. It is essential to ensure the right tools, configured for optimization, are deployed. Whether assessing existing systems or evaluating new tools, priority should be given to proper configuration before any considerations of customization. While customization often sounds like the right answer in the short term, it will create challenges during upgrades and integrations down the line. When building for scale, limiting customizations will provide the greatest opportunity to leverage a tool across the broadest segment of the organization. Remember, configure first, customize second.

4. Strong Controls

Mitigating risks lessens unforeseen liabilities. Automation is frequently cited as one of the main ways to mitigate operational risk. We agree, but with some caveats. Automated systems speed up processes, yet they can also increase risks under certain conditions. Errors, technological and manual, can propagate in a firm’s infrastructure in nanoseconds. Technology is fundamentally obtuse, and naïve reliance on it could potentially increase a firm’s risk¹⁰.

Fat finger requests, if unnoticed, can cause serious trouble, and they frequently bring systems to a grinding halt. Such incidents are not exclusive to the front office as, for example, the use of API calculators and utility-based pricing models has grown in the industry. Meradia has advised firms to employ rigorous controls – both procedural and systemic – to mitigate the impact of these scenarios, thereby resulting in less operational risk. A real-world case below illustrates this.

Risk Barricades: A client’s self-service portals were designed to send requests directly to a vendor’s risk calculation engines that operated on a pay-as-you-go pricing model. Meradia defined the monitoring process that included generation of alerts as requests reached a critical threshold. Operations personnel closely monitored where price points changed and provided approvals. This greatly reduced the possibility of monthly invoice surprises from vendors.

The Right Mix

Firms grow in different ways and respond to that growth uniquely. The challenges of growth can be temporarily assuaged by deploying any of the methods described herein. However, unless the chosen approach is deployed as part of a strategic plan, it is likely to introduce inefficiencies and negatively impact the bottom line. Decisions to add headcount or implement new technology tools may provide short-term, tactical benefits. However, to maximize efficiency and subsequently profits over the longer term, the factors described people, process, tools, and controls should not be evaluated in isolation. Instead, they are part of a broader system the operating model which must be assessed in aggregate. The ideal operating model is unique to the organization and includes the right mix of people, processes, tools, and controls. Meradia’s methodical framework helps our clients ensure that they build an operating platform that drives ongoing efficiency, scalability, and, above all, profitability.

Operational Transformation: Meradia’s role as a trusted advisor involved defining the performance target operating model of a trillion-dollar global asset manager. As an example, the holdings-based analytics process was subject to thorough assessment and benchmarking against industry practices. A configuration-oriented approach redesigned the functionality in market-data-enabled vendor platforms. This, in turn, enabled the operations team to self-fulfill ad hoc service requests, potentially reducing time to market from 60 hours to less than 60 minutes.

Where Meradia Comes In

When it’s important to improve operating efficiency and minimize risk, Meradia brings a comprehensive framework to solve business and technological challenges, including proven methodologies and skills to:

- Assess the existing infrastructure and its suitability for growth

- Identify key pain points

- Formulate a risk-resilient target operating model

As demonstrated in the examples throughout this article, Meradia has the experience, expertise, and market knowledge to help you with these or any other investment operations or performance challenges. Our sole focus is to maximize value for our clients. Contact us today to learn more.

References

¹ The State of Alternative Investments in 2022. CAIA, Accessed on 9/10/2022.

² Global Assets under Management set to rise to $145.4 trillion by 2025, PWC, Accessed on 9/14/2022.

³ $1B+ US asset management deal space off to strong start in 2022, S&P Global, Accessed on 9/14/2022.

⁴ It Doesn’t Matter by Nicholas G. Carr, Harvard Business Review, Accessed on 09/19/2022.

⁵ Outsourcing: An Insider’s Framework For Finding The Right Service Provider, Meradia

⁶ Look Before You Leap: A Risk-based Framework To Aid Middle- And Back-office Outsourcing, Meradia

⁷ Risk Statistics in Performance Calculators: Suitable & Scalable? Journal of Performance Measurement, Spring 2020,

⁸ Automation: Taking Back Control From Excel And Email Anarchy, Meradia

⁹ Is RPA The Right Solution To Optimize Your Investment Operations? Meradia

¹⁰ Refer to the chapter ‘The Downside of Automation’ in Top Ten Operational Risks by Holly Miller & Philip Lawton.

Download Thought Leadership Article Process Design and Change Performance, Risk & Analytics Asset Managers Jonathan Boersma, Jose Michaelraj info@meradia.com

info@meradia.com