DELINEATING AND DEFINING THE DIFFERENT BOOKS OF RECORD: ABOR, IBOR AND PBOR

A quick web search shows the term PBOR is gaining traction. Most major technology vendors that provide investment performance measurement and related data management solutions use the term on their websites. The concept is used to position a wide array of services and technology to address the need to consolidate data, generate performance returns and support strategic analysis. FinTech vendors are not alone in using the term PBOR. Multiple asset managers have adopted the term, and many are currently working to establish a reliable performance book of record. These projects have become a priority to increase transparency across direct holdings and underlying exposures; and to support enterprise-wide data analysis that has become more critical during volatile financial markets.

When the term PBOR first appeared in print in 2014 many thought it was just a marketing ploy to promote financial technology by Eagle Investment Systems. This skepticism was understandable given the focus on Investment Book of Record solutions at the time. Specific challenges to the term ranged from:

- Why are accounting books of record not enough?

- How can performance be called a book of records?

- How is a PBOR different than a performance measurement system?

These are all good questions to understand why it is important for all sophisticated asset management and asset owner organizations to consider a performance book of record.

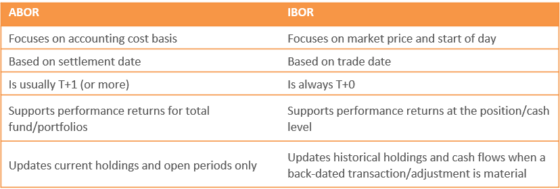

Delineating the differences between an Accounting Book of Record (ABOR) and an Investment Book of Record (IBOR) is fundamental before defining a Performance Book of Record (PBOR).

Both accounting books of record fall short of modern-day front office expectations. This perhaps is why the middle office has become so important for the industry lately. Performance teams and the latest buzzword ‘middle office’ are overlapping concepts because they both focus on the same data and outputs. A performance book of record overlaps middle office functions given both expect the same consolidated, enriched and extremely granular data on portfolios and results. In the same way a middle office is expected to answer the most demanding questions from the front office, a performance book of record is responsible for managing enterprise-wide data to generate the information the middle office relies upon to answer front office requests. Middle office teams and PBOR solutions are responsible for supplying every bit of information needed for complex reporting for investment board packages, fund prospectuses, private holding valuations or composite household reporting. A performance book of record supports all these complex information requests through a broad set of data and processes, such as:

- Firmwide security masters, characteristics and analytics for all holdings and benchmarks constituents.

- Calculation of reliable performance returns on each investment, cash balance and underlying exposure.

- Organization of the lowest level fund share class entities up to the top-down views of composited strategies and client accounts.

- Risk modeling, scenario analysis and stress testing strategies.

- Unified investment results and structured analysis necessary for management and client reporting.

These PBOR processes result in valuable enterprise data. With a reliable PBOR, firms can confidently report the investment results and analysis required to explain a portfolio management value proposition and generate next-level growth for asset managers.

WHY ARE TRADITIONAL PERFORMANCE SYSTEMS NOT ENOUGH?

PBORs must combine data from multiple sources of accounting books, security masters, analytics, underlying exposures, market indices, strategic benchmarks along with all relevant firm and client data which is usually encrypted and certainly not stored in a performance system. Beyond generating performance results, this data coalesces to inform conversations between asset managers and assets owners. Client and asset owner expectations are increasing with information requests ranging from “How did my total portfolio perform?” to “Where are my exposures mis-aligned with agreed strategies?” to “How can I better hedge my risks?”. These questions go far beyond what most performance measurement systems can support today. PBOR platforms must involve deep data governance activities to hold together the layers of data needed by a firm to produce analysis expected on complex investment strategies, multiple asset classes and overlay managers. PBORs should also safely support data science activities like data mining as firms look to unlock the value of data.

Governance over all internal and external sources of data involved can be mind-numbing. Where are the data gaps? How are breaks being closed, and under what controls or audit trails? Investment operations and technology teams use performance systems, risk systems, database solutions, market data solutions and multiple reporting tools to support the entire process. This common enterprise platform is the lifeblood of most asset management organizations and deserves a clear industry definition. Performance solutions alone cannot solve these enterprise problems and so most are not considered a PBOR. The investment management industry has been prioritizing resources to unify data and better govern how information is used across organizations for years. This trend has greatly improved investment data solutions and data governance as a practice, while the cost of data storage continues to fall and cloud solutions gain traction.

This is usually due to growth in a specific asset class, division, or a merger or acquisition and the need to address a burning operational issue. The existence of multiple performance systems in many ways spurred the call for a PBOR to rationalize asset class or fund product specific returns into a client-ready information hub.

DATA ENRICHMENT, MANUAL PROCESSES AND OTHER OPERATIONAL RISKS WARRANT A BETTER INDUSTRY SOLUTION

Most firms cannot budget or prioritize system rationalization while growing a new fund product. Frequent mergers and acquisitions compound the problem and should only be expected to increase across the industry as management fee and operating margin pressures rise. These realities explain why redundant, manual and divergent systems are so common. Compounding this challenge are unaddressed legacy problems such as outdated platforms for specific subsidiary, asset class or the wide use of Excel-based procedures. Manual procedures are an operational risk that continues to plague the industry. Performance and risk teams are particularly challenged by a plethora of systems and Excel workarounds that pop-up to quickly address time-sensitive requests from the front office.

Investment operations and enterprise data management programs demand enormous budgets, yet it is unclear if firms are getting what they pay for. It is unlikely if they have multiple books of records and still have not achieved reliable and consistent performance and analysis processing down to the underlying exposure level on a daily basis. This level of performance data management is what is necessary for regular attribution reporting and, in turn, to help front offices explain a firm’s value proposition to clients and prospects. Technology has advanced to where the industry can do a much better job of using all the detailed data they produce; but only if a firm invests in their PBOR platform.

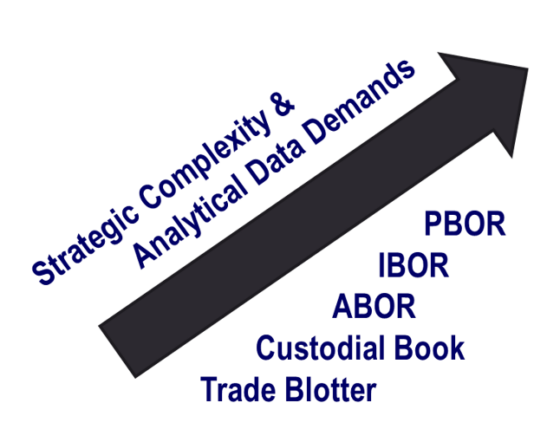

MATURITY AND COMPLEXITY PROGRESSION

In the past, complex investment instruments and global fund products accelerated operational maturity. Today open data ecosystems are pushing the industry forward in exciting ways.

PBORs are central to provisioning clean and actionable data for investment professionals; and more and more often teams of data scientists are experimenting to find the next growth strategy ahead of the competition.

PBOR OR A MIDDLE OFFICE PLATFORM?

Whether they are called a performance book of record or something else, platforms that truly manage firm-wide asset data and performance results to produce analysis and risk information efficiently are what investment managers need to navigate an ever-changing sea of data requests. These platforms are used by middle offices are expected to support performance measurement based on true daily security and sub-security level rates of returns. This is the threshold for a PBOR because this return is best to compare an investment to an index by the nature of being the fundamental building block for attribution and risk analysis. This simple but necessary level of performance data is challenging to produce and maintain historically on a day-to-day basis. Having the best accounting systems feeding daily positions and cash flows is still not enough.

Accounting systems, IBORs and other middleware fail for all sorts of reasons. Some cannot provide ‘as-of’ updates back in time on a daily basis. Others cannot support lagged valuations or restatements where multiple versions of the truth must be maintained historically based on alternative prices. Layer on top of these steps the need to align multi-strategy funds, overlay managers and layered benchmark or policy targets; and the unique enterprise need for a PBOR becomes evident.

Legacy accounting books and newer investment books of records lack critical views of notional exposures, look-through on structured instruments and the granular security analytics data needed to align portfolios to benchmarks and produce sophisticated attribution analysis and other strategic analysis that portfolio managers require to explain the value of investment decision to clients.

PBOR PROJECTS ARE UNDER WAY ACROSS THE INDUSTRY TO FILL THE DATA GAP

Asset managers and asset owners are clearly aware of the operational challenges discussed here. Many have enterprise data management or data-is-everyone’s-responsibility style programs under way to address weaknesses or fortify platforms to manage operational risks. Focusing these industry problems into a performance book of record is a useful strategy because the complexities of enterprise data governance are central to a PBOR. The usefulness of defining this holistic problem set as a PBOR is tied to the key question most investors ask their advisors, “How did my portfolio perform?”. The base metric in this question is, of course, a daily performance return in each asset, currency and underlying exposure. Calculating a reliable investment return seems trivial but for the reasons outlined above, a performance book is a complex problem to solve for today’s global investor.

Performance teams are central to the process; but they are joined by many other groups across the middle office from compliance, risk, legal and marketing to portfolio management teams. Most asset management organizations that support these functions call it a middle office, and the platform upon which it relies is best described as a Performance Book of Record (PBOR). The cost-effective deployment of PBOR platforms and middle office operations are a vital component for the next level of growth in the investment management industry.

HOW MERADIA CAN HELP

When an asset management organization is ready to address complex challenges like rationalizing systems or implementing a new platform, Meradia recommends a data driven approach and learning from the lessons of peers. Not all risks can be addressed in single mitigating action; but plotting a course to deliver incremental value and resilience is critical. Meradia brings a comprehensive toolkit to the table to help clients solve business and technology challenges including proven methodologies and skills to:

- Architect enterprise data platforms

- Develop information delivery strategies

- Identify appropriate vendor partners, tools and platforms

- Integrate and transition new solutions to production

- Provide strategic guidance on building a Performance Book of Record

Download Thought Leadership Article Solution Design, System Rationalization Performance, Risk & Analytics Asset Managers Richard Mailhos

info@meradia.com

info@meradia.com