Like many industries, wealth management is undergoing a change. Demographic and generational shifts in wealth will continue to reshape services and enhance the digital experience . In a survey of 120 wealth managers, 87% reported that they have made significant investments in technology over the past several years¹. Tech transformations within large wealth management firms are often achieved through integrations of vendor platforms with proprietary applications, as stakeholder needs are particularly diverse. A single platform solution may solve for a set number of stakeholders, but firms with various client types require multiple solutions that integrate seamlessly. Deciding on the best technology partners requires a proven, structured approach to technology evaluation.

Technology Advances in Wealth Management

Many of the survey participants previously mentioned are focused on providing better access to data and client reporting. Increased investing in interactive portals² and delivery channels (mobile apps, etc.) is also common (see this Meradia article for more information). Mass affluent and high-net-worth investors have reacted positively to communication via such channels, while there is still opportunity for further improvement with UHNW investors. Traditional wealth management firms often require a change to their legacy technology solution . They may have incrementally bolted-on solutions in response to shifting investor preferences, expansion of investment options, demand for omnichannel access, and the high-tech competitive landscape. The demand to address these expectations now often wins over strategic architectural decisions to deliver a seamlessly integrated solution.

Global Demographic Changes and Investor Preferences

Wealth firms need to consider demographic factors when defining services. For example, more millennials and Gen X clients will increasingly have a say in the services they expect from wealth management firms and how these services are offered, such as their preference for a digital experience. This demographic shift is expected to be much higher in Latin America & Asia vs. North America³ and may provide a competitive advantage for firms already offering these services. Several other trends are driving technological changes, such as direct indexing, goals-based investing, and exposure to alternative asset classes. In turn, these trends place pressure on performance and reporting technology platforms to support after-tax returns, comparisons to goals, and the unique data challenges of alternative investments, such as private equity.

Considerations for Target State Architecture

Solving for scalability for mass affluent investors while offering tailored services for UNW and family offices imposes challenges on a firm’s infrastructure. Wealth management firms expanding into new market segments must often transform their existing landscape to address the different needs of these audiences. Transformation typically starts with architecture, which sets the direction for how the various tools and supporting processes should tie together. Broadly, the architectural design for wealth management performance and reporting solutions can be described as either a single platform or integrated applications.

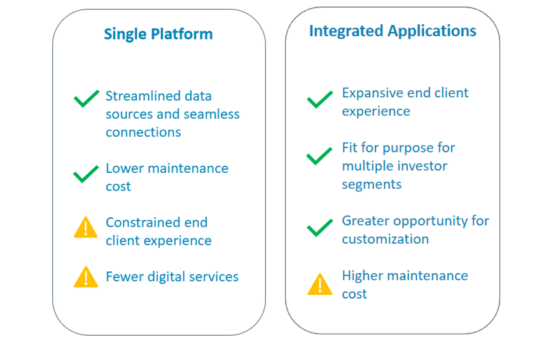

Both approaches offer advantages and impose limitations. Figure 1 illustrates the typical strengths and weaknesses with regard to functionality and total cost of ownership.

Figure 1: COMPARISON OF SINGLE PLATFORM VS. INTEGRATED APPLICATIONS Source: Meradia

Single Platform Architectural Design

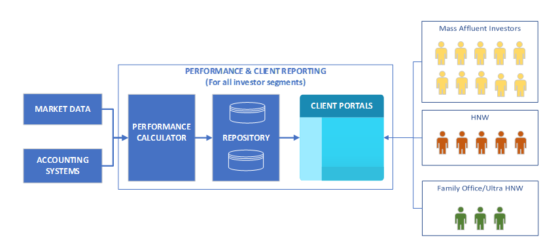

Platform architectures deliver nearly all capabilities through a centralized solution stack. The stack is often tightly unified, and services are delivered through a repository or portal. A common configuration is to have all investor segments (mass affluent, HNW, UNHW) connected to the same distribution mechanism, like a client portal. (See Fig 2 below)

Figure 2: SINGLE PLATFORM ARCHITECTURAL DESIGN Source: Meradia

Integrated Applications Architectural Design

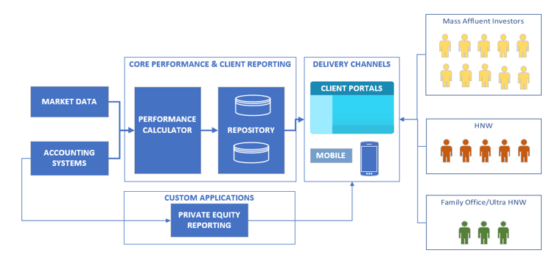

Integrated application design maximizes the offering in terms of functionality by adopting a best-of-breed approach to solve for each component and build connections. These tech solutions often mix and match vendor applications (one or more) and proprietary applications together. Multiple distribution channels can cater to the distinct nature of service expected by each investor segment.

Firms using these platforms will find it easier to service more sophisticated UHNW clients who invest in private equity and real estate. These investments necessitate IRR calculations and specialized reporting on committed vs. invested capital . Firms that need advanced analytics, such as equity and/or fixed income attribution, may also benefit from an integrated design.

An integrated architectural design accelerates the expansion of additional features to meet the needs of more diverse client segments. Here are some examples:

- Functions performed through one or multiple applications in addition to the core application to support growth into new market segments.

- Adding or modernizing digital delivery through mobile devices to cater to the preferences of Gen X.

- Integrating the newest technical advancements, such as “scrollytelling(4)” narratives and/or pushing frequent updates through alternative channels.

Figure 3: INTEGRATED APPLICATIONS ARCHITECTURAL DESIGN Source: Meradia

In addition to better client experience, wealth managers can benefit from accelerated implementation of a cohesive digital strategy. Wealth managers can obtain insights into client behavior and could provide pointers toward prospective product positioning.

Vendor Assessment Framework

For wealth management firms, scalability and highly specific reporting needs are often the primary drivers of a vendor selection process. On the other hand, asset management firms require functionality and flexibility of calculations as their top priorities from a performance vendor. The tech solution for wealth managers should support all reporting functions at scale and work seamlessly with the packaging workflows. This warrants performance and client reporting vendors to be assessed in unison . As a result, the vendor selection framework must be explicitly designed to account for these factors.

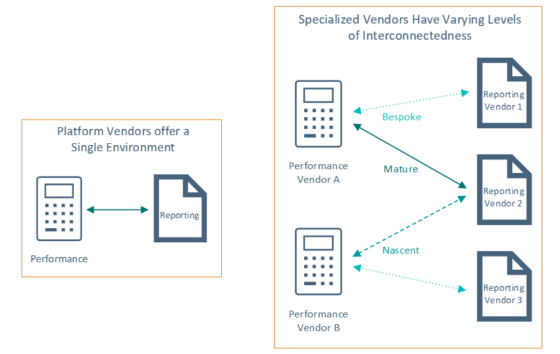

Vendors in the wealth management space fall on a continuum, from stand-alone solutions offering either performance or reporting to tightly integrated platforms offering both functions. Multiple vendors also exist in the middle area with individual, partially integrated performance and reporting products. At each of these points along the continuum, we can find a variety of vendor offerings from adequate, low-cost solutions to high-tech platforms with interactive capabilities.

There are several key factors to consider when selecting a vendor. Buyers at the far ends of the spectrum are more easily defined. Very large firms servicing private wealth and institutional clients with a sophisticated performance calculation engine and teams with technical skills to build integrations are typically best served by a stand-alone reporting-only solution. Conversely, RIAs with fewer internal technical resources often select a platform solution that acts as a single destination for data ingestion and cleansing, performance calculations, and client reporting. Firms that fall in the middle need to decide when to build vs. buy and consider the cost-benefit and risks for assorted options. Selecting the best fit depends on the specific needs of the business.

Below are just some factors that help narrow down the field of potential vendors:

- Global or Domestic: Is there a need to report in multiple currencies? Do returns need to be calculated in both base and local currencies? Some highly rated performance and reporting vendors only work well for a single currency. This can be a major impediment to global expansion for a firm.

- Performance-Ready Data: Is there a need for data ingestion, normalization, and enrichment from one or more accounting sources? Some performance and reporting engines rely on an upstream accounting system to prepare the data and adjust as necessary to produce accurate returns. Custodian data can be problematic for wealth management firms.

- Account Hierarchies: Are returns calculated and reported on groups of accounts? Some systems require this to be pre-defined while others support on-the-fly aggregates. Are sleeve-level returns important? These are typically part of a platform offering.

- Customizable Client Meeting Books: Do client advisors need a report packaging solution to build a presentation to tell a story? User-friendly report packaging tools are lacking, with some vendors leaving it up to manual work to build packages, thus increasing risk and limiting opportunities to scale.

- Bulk Reporting: Are quarterly performance reports part of the service offering? If so, consider whether the vendor’s technology can scale to support several thousand clients (not hundreds) and automate the inclusion or exclusion of content based on attributes.

The Unicorn: Seamless Integration

The ability to completely satisfy all the factors listed above may be too complex for a single platform, thus creating the need to integrate. Integration of two distinct solutions built on different data sets is never seamless, so it is reasonable to expect some manual intervention at times. The objective during the vendor selection process is to gain confidence in the probability of it working effortlessly.

For more mature interfaces, existing clients have encountered issues and worked with the vendor(s) to resolve them. Proceed with caution with nascent interfaces that lack a track record of scalability, correct handling of alternatives, or other complex scenarios. Also, beware of bespoke interfaces built specifically to support a firm’s needs, as they may not be supported with future product upgrades.

Figure 4: INTEGRATION SCENARIOS BETWEEN PERFORMANCE AND REPORTING Source: Meradia

HOW MERADIA CAN HELP

At Meradia, we understand that wealth managers face unique challenges. Factors such as data aggregation, P&I reporting, after-tax returns, and evolving client preferences require a special lens to evaluate wealth management platforms effectively.

Meradia’s vendor selection framework includes a robust questionnaire to uncover factors underpinning each category mentioned above specific to wealth management requirements in the performance and client reporting space. Our thorough industry research and close alliances with many vendors help us identify key differentiators of each platform. Deep knowledge of wealth business processes and systems integration enables us to derive the combined value proposition of different platforms. Insight into vendor product roadmaps and industry foresight helps us identify suitable technology partners for your changing landscape.

When it is time to upgrade your wealth ecosystem, Meradia brings a rigorous framework and the necessary knowledge base to:

- Assess the current suite of systems and processes

- Uncover key pain points

- Identify the right technology partner(s)

- Lead large transformation projects

- Implement modern technology

Our sole focus is to maximize value for our clients. Contact us today to learn more.

REFERENCES

[1] bfinance. (2021). (rep.). Wealth Manager Investment Survey. Retrieved January 27, 2023, from https://www.bfinance.com/insights/wealth-manager-investment-survey/.

[2] Jager, T. (2022, November 28). The evolution of client experience and client communications. Meradia. Retrieved January 27, 2023, from https://meradia.com/thought-leadership/the-evolution-of-client-experience-and-client-communications/

[3] Roubini Thought Lab. (2021), (rep.). Wealth & Asset Management 2021: Preparing for Transformative Change. Retrieved January 31, 2023, from https://thoughtlabgroup.com/wp-content/uploads/2018/02/Wealth-2021-report_final.pdf

[4] Scrollytelling is a combination of text, pictures & animation in an interactive mode (scrolling) to convey a story (telling).

Download Thought Leadership Article Solution Design, System Rationalization, Vendor Selection Client Experience, Front Office & Portfolio Management Wealth Managers Jose Michaelraj, Josh Gerwick, Tina Madel info@meradia.com

info@meradia.com